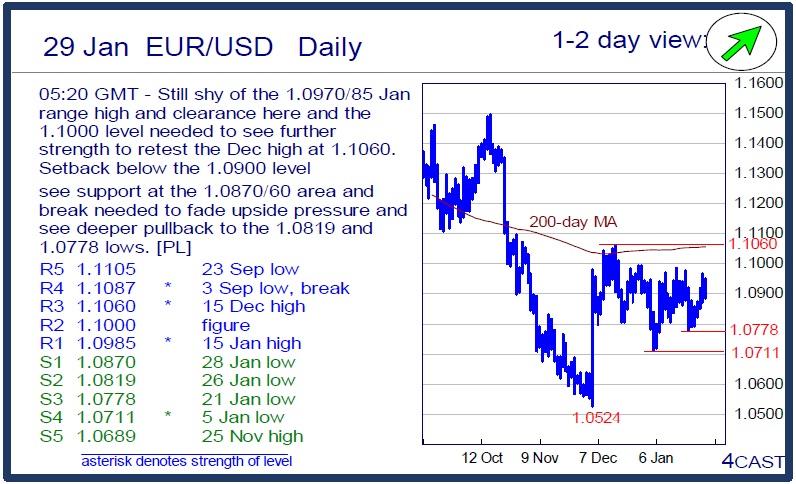

EUR/USD Daily

Still shy of the 1.0970/85 Jan range high and clearance here and the 1.1000 level needed to see further strength to retest the Dec high at 1.1060. Setback below the 1.0900 level see support at the 1.0870/60 area and break needed to fade upside pressure and see deeper pullback to the 1.0819 and 1.0778 lows. [PL

EUR/CHF Daily

Saw spike above the 1.1107 high to reach fresh high at 1.1134 before settling back below the 1.1100 level. Further strength will see scope to the 1.1145/60 area though the stretched intraday and daily tools caution corrective pullback with support now at 1.1050 and the 1.1000 level. Would take break of 1.0982 support to fade upside pressure. [PL]

USD/CHF Daily

Saw spike above the 1.0200 level to reach fresh high at 1.0224 but gains not sustain. Clear break will see scope to the 1.0300 level then 1.0328 high. Would take break of the 1.0118/11 lows to trigger a small top pattern and see stronger pullback within the 7-wk up channel to parity level then .9959/50 support and the lower channel. [PL]

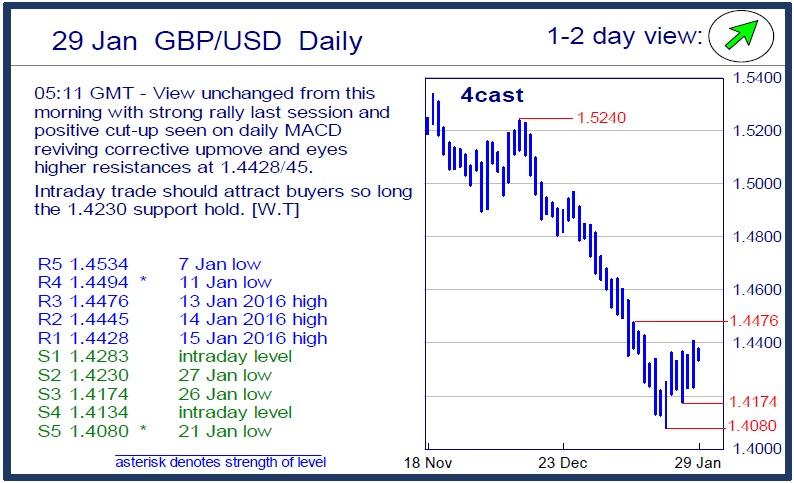

GBP/USD Daily

View unchanged from this morning with strong rally last session and positive cut-up seen on daily MACD reviving corrective upmove and eyes higher resistances at 1.4428/45. Intraday trade should attract buyers so long the 1.4230 support hold. [W.T]

USD/JPY Daily

Strong rally above the 120.00 saw spike to 121.42 high ahead of an equally sharp pullback. Volatile price action see the pair regaining the 120.00 level and hold above this will see scope to retest 121.42/48 high and the 200-day MA. Clearance will open up 122.00/20 area. [PL]

EUR/GBP Daily

Failure to clear the .7654/70 resistance see mkt settling back in consolidation and below the .7600 level expose the .7550/26 lows to retest. Below this see the .7500 key and where break is needed to swing focus lower to further retrace up-leg from .6983, Nov low. Break will see scope to .7460 then .7424/00 area. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.