EUR/USD

Extending the drop from Mon's 1.0970 high to reach 1.0820 low and nearby see the 1.0800 level to watch as break will expose the 1.0771 support then 1.0711 low to retest. Resistance now at 1.0900/10 area and lift over this needed to clear the way for return to the 1.0940 and 1.0970 resistance. [PL]

USD/CHF

Bounce from the .9881 low to regain parity level seeing follow-through above the 1.0052 resistance. This clears the way for return above the 1.0100 level to retest the 1.0125 high. Bullish structure see support now at the .9966 then the .9923 and .9881 lows. [P.L]

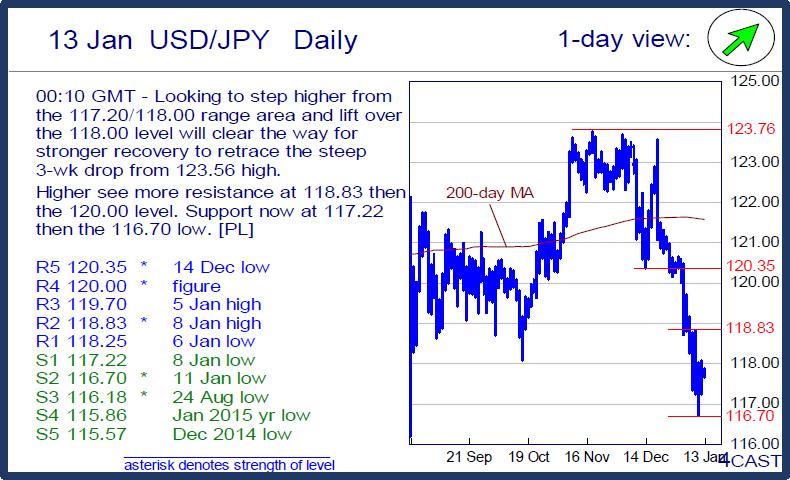

USD/JPY

Looking to step higher from the 117.20/118.00 range area and lift over the 118.00 level will clear the way for stronger recovery to retrace the steep 3-wk drop from 123.56 high. Higher see more resistance at 118.83 then the 120.00 level. Support now at 117.22 then the 116.70 low. [PL]

EUR/CHF

Retains upside bias from the 1.0778 low and strength above 1.0885 expose the 1.0900 level to retest. Lift above the latter will clear the way for retest of the 1.0940, Dec high. Would take setback to break 1.0827 support and the 1.0800 level to weaken and see return to 1.0778 and 1.0756 lows. [PL]

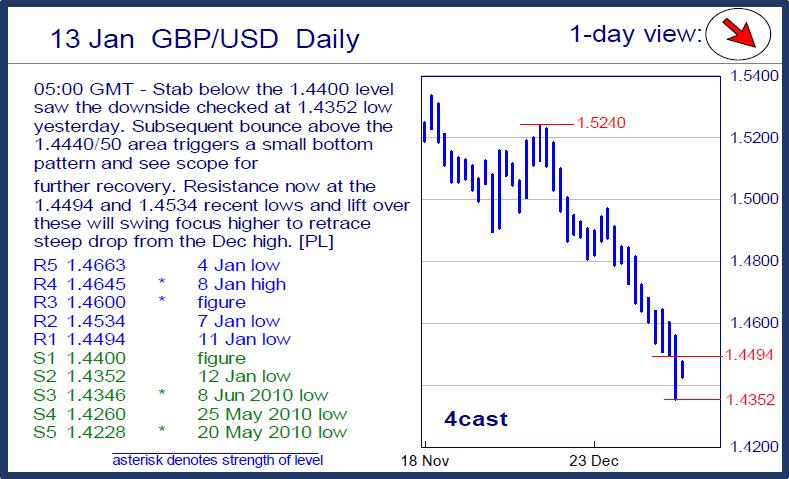

GBP/USD

Stab below the 1.4400 level saw the downside checked at 1.4352 low yesterday. Subsequent bounce above the 1.4440/50 area triggers a small bottom pattern and see scope for further recovery. Resistance now at the 1.4494 and 1.4534 recent lows and lift over these will swing focus higher to retrace steep drop from the Dec high. [PL]

EUR/GBP

Below the .7555 high keep ranging action in play around the .7500 level. Support is at the .7424/00 area and where break is needed to swing focus lower to correct the 8-wk up-leg from .6983 low. Clear break above the .7500 level and .7555 high will see extension to target .7592 then .7654, a 38.2% retracement level. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.