EUR/USD Daily

Bounce from the 1.0711 low see mkt consolidating the break of the 1.0800 level and see the latter now reverting to resistance. Would need to regain this to fade the downside pressure. Below the 1.0711 low and the 1.0700 level will trigger deeper setback to the 1.0638 then 1.0600 level. [PL]

USD/CHF Daily

Settling back from the 1.0125 high though hold above the parity level keep focus on the upside for retest of the Mar/Jan 2015 highs at 1.0129 and 1.0240. Beyond this will expose the 1.0328 Nov high to retest. Setback below the .9991 support needed to ease upside pressure. [P.L]

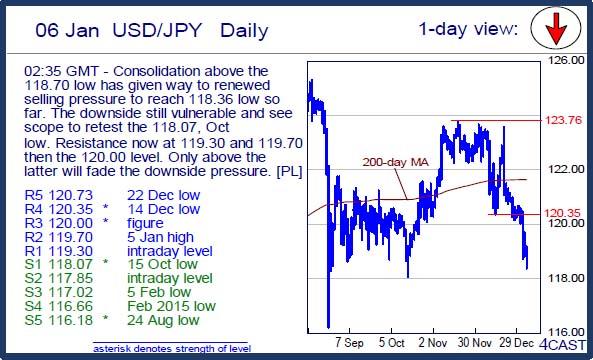

USD/JPY Daily

Consolidation above the 118.70 low has given way to renewed selling pressure to reach 118.36 low so far. The downside still vulnerable and see scope to retest the 118.07, Oct low. Resistance now at 119.30 and 119.70 then the 120.00 level. Only above the latter will fade the downside pressure. [PL]

EUR/CHF Daily

Rejection from the 1.0901 high keep mkt confined to ranging action within the 1.0900/1.0800 area. Would take break of the 1.0800 level to weaken and expose the higher lows at 1.0778 and 1.0756 to retest. More ranging action seen for now and only lift above 1.0900 will expose 1.0940 Dec high to retest. [P.L]

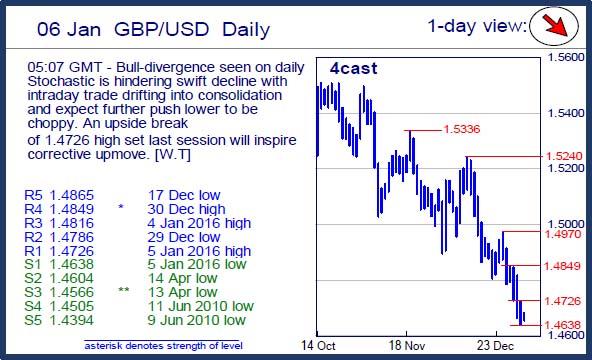

GBP/USD Daily

Bull-divergence seen on daily Stochastic is hindering swift decline with intraday trade drifting into consolidation and expect further push lower to be choppy. An upside break of 1.4726 high set last session will inspire corrective upmove. [W.T]

EUR/GBP Daily

Failure to clear the .7400 level see pressure returning to the downside to approach the .7308 support. Break here will trigger a top pattern and see deeper pullback to retrace the up-leg from .6983 low. Upside see resistance now at .7370 then the .7400/24 area. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.