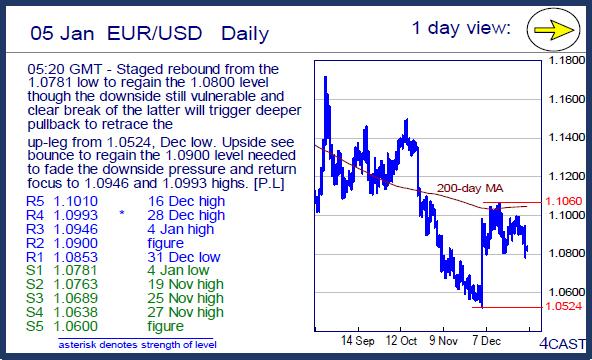

EUR/USD Daily

Staged rebound from the 1.0781 low to regain the 1.0800 level though the downside still vulnerable and clear break of the latter will trigger deeper pullback to retrace the up-leg from 1.0524, Dec low. Upside see bounce to regain the 1.0900 level needed to fade the downside pressure and return focus to 1.0946 and 1.0993 highs. [P.L]

USD/CHF Daily

Rebound from the .9924 low to regain the parity level saw mkt reaching fresh high at 1.0063 yesterday. Hold above the parity level will see scope for retest of the Mar/Jan 2015 highs at 1.0129 and 1.0240. Beyond this will expose the 1.0328 high to retest. Support now at .9991 then the .9924/00 area. [P.L]

USD/JPY Daily

Bounce from the 118.70 low seen unwinding the stretched intraday tools though the downside still vulnerable. Break of the 118.70 low will see scope to retest the 118.07, Oct low. Upside seen limited with resistance now at 119.70 then the 120.00 level and 120.35, recent low. [PL]

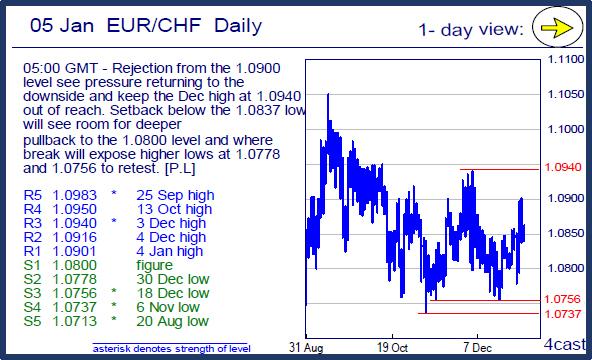

EUR/CHF Daily

Rejection from the 1.0900 level see pressure returning to the downside and keep the Dec high at 1.0940 out of reach. Setback below the 1.0837 low will see room for deeper pullback to the 1.0800 level and where break will expose higher lows at 1.0778 and 1.0756 to retest. [P.L]

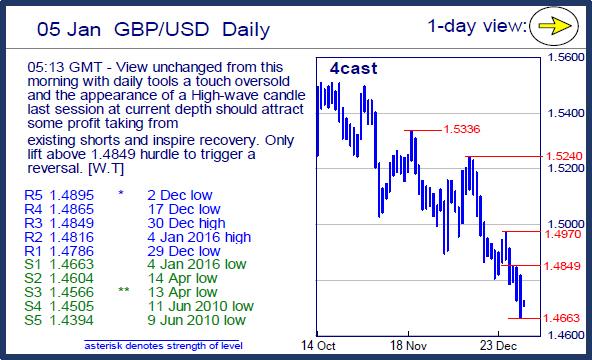

GBP/USD Daily

View unchanged from this morning with daily tools a touch oversold and the appearance of a High-wave candle last session at current depth should attract some profit taking from existing shorts and inspire recovery. Only lift above 1.4849 hurdle to trigger a reversal. [W.T]

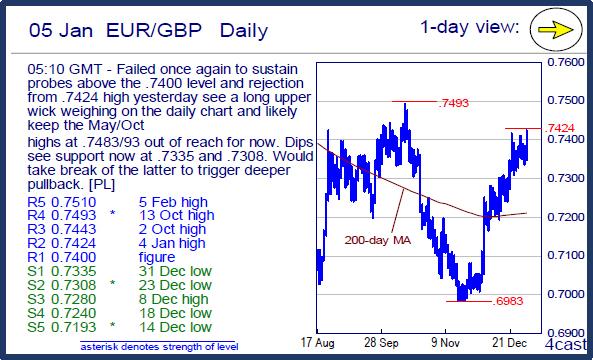

EUR/GBP Daily

Failed once again to sustain probes above the .7400 level and rejection from .7424 high yesterday see a long upper wick weighing on the daily chart and likely keep the May/Oct highs at .7483/93 out of reach for now. Dips see support now at .7335 and .7308. Would take break of the latter to trigger deeper pullback. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.