EUR/USD Daily

With most players closing their book for the Year 2015, intraday trade remains tight, exposing little interest to create fresh positions with support seen at 1.0899 ahead of 1.0870. On the upside, strong resistance is seen at 1.0993. Happy and Healthy Year 2016 to All. [W.T]

USD/CHF Daily

With the Year 2015 coming to an end , bulls are reluctant to push higher as players squared off their positions and now settling prices back to consolidation. A break of wider and stronger 0.9786-0.9990 band will trigger clearer signals. [W.T]

USD/JPY Daily

With the Year 2015 ending and most of Fareast on holiday or partial working day, intraday trades remain tight in consolidation and current rebound seen as correcting the broader downmove from 123.56 high and should see selling appearing towards 120.73/98 resistances. Happy and Healthy New Year 2016 to All. [W.T]

EUR/CHF Daily

Spurred by the negative implication of High-wave candle set on Tuesday, prices staged a strong reversal to 1.0778 low last session and trades are now reverting to consolidation . Happy and Healthy New Year 2016 to All. [W.T]

GBP/USD Daily

With most players closing their books for the Year 2015 and the appearance of a Doji-session last session, further decline stalled with intraday trade drifting into tight consolidation. A Happy and Healthy New Year 2016 to All. [W.T]

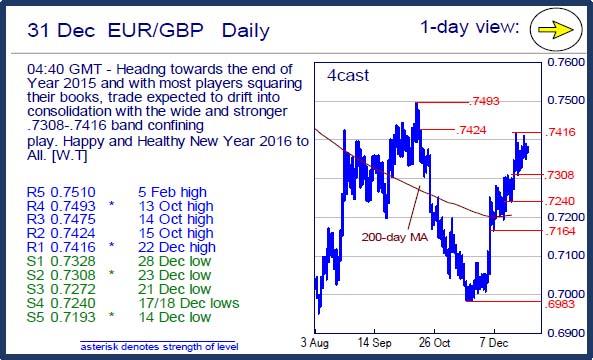

EUR/GBP Daily

Headng towards the end of Year 2015 and with most players squaring their books, trade expected to drift into consolidation with the wide and stronger .7308-.7416 band confining play. Happy and Healthy New Year 2016 to All. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.