EUR/USD Daily

Strong rally last session keeping this currency pair on a firm undertone during intraday trading and pushing above 1.0939 resistance will trigger extension to 1.0981. Good support is now protecting at 1.0796 and below latter to reverse focus towards downside. [W.T]

USD/CHF Daily

Short-term trade remains consolidative and bulls need clearance above the 0.9990 resistance to gain footing towards next hurdle at 1.0034 and only break of the latter to signal more upside potential. Support seen at 0.9890 and slip of the latter to help bears regain footing towards strong support at 0.9786. [W.T]

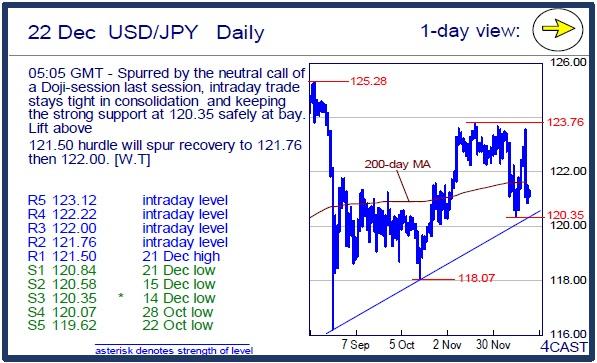

USD/JPY Daily

Spurred by the neutral call of a Doji-session last session, intraday trade stays tight in consolidation and keeping the strong support at 120.35 safely at bay. Lift above 121.50 hurdle will spur recovery to 121.76 then 122.00. [W.T]

EUR/CHF Daily

Failure to clear the 1.0756 support last session triggered a strong reversal from the latter with prices now turning towards the 1.0859/77 congestion highs and clearance will shift focus higher towards 1.0940. [W.T]

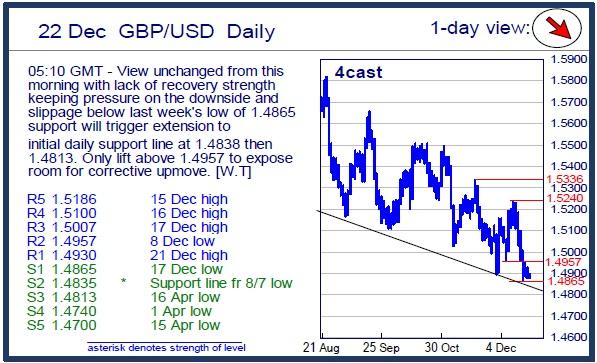

GBP/USD Daily

View unchanged from this morning with lack of recovery strength keeping pressure on the downside and slippage below last week's low of 1.4865 support will trigger extension to initial daily support line at 1.4838 then 1.4813. Only lift above 1.4957 to expose room for corrective upmove. [W.T]

EUR/GBP Daily

Strong rally above .7307 resistance last session setting the bigger upmove from .6983 low back in motion and this should keep this cross on a firm undertone into European trading with bulls eyeing higher resistance at .7374 then .7493. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.