EUR/USD

Near a significant support area.

-

EUR/USD has significantly declined for the last two sessions. However, a key support area can be found between 1.2662 (13/11/2012 low) and 1.2797. Hourly resistances can be found at 1.2869 (intraday low) and 1.2932 (see also the declining channel).

-

In the medium-term, the rise from 1.2746 (04/04/2013 low) is viewed as a corrective phase within a larger downtrend. Therefore, we eventually expect to see prices moving below the key support at 1.2662 (13/11/2012 low). However, the short-term oversold conditions suggest that a break to the downside without a prior rebound is unlikely.

Await fresh signal.

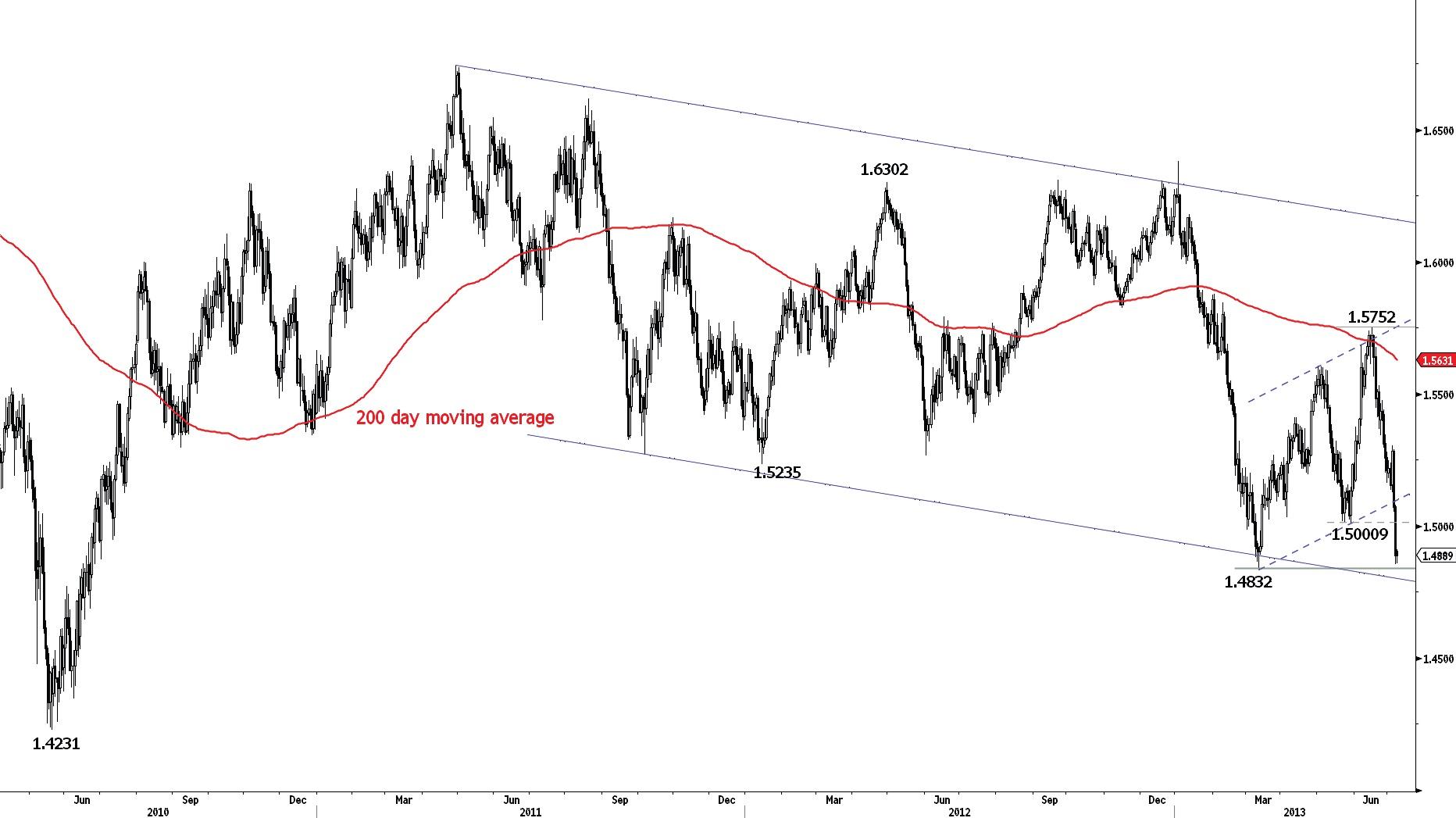

GBP/USD

Approaching the 2013 low at 1.4832.

-

GBP/USD has sharply declined for the last two sessions. The support at 1.5009 has been broken. Monitor the key support at 1.4832. The short-term technical configuration remains negative as long as prices remain below the resistance at 1.5130 (03/07/2013 low). An initial resistance can be found at 1.5028 (intraday low).

-

In the longer-term, the break of the horizontal range defined by the strong support at 1.5235 (13/01/2012 low) and the strong resistance at 1.6302 (30/04/2012 high) calls for a further medium-term decline. However, monitor the support at 1.4832 (12/03/2013 low) given the increasing short-term oversold conditions.

Await fresh signal.

USD/JPY

Making new highs.

-

USD/JPY continues to rise, breaking its recent high at 100.86. Other resistances are at 101.80 (30/05/2013 high) and 102.59. Hourly supports can be found at 100.46 (intraday high, see also the rising trendline) and 99.26 (03/07/2013 low).

-

The medium-term overextended nature of this market calls for some caution. However, the sharp rise from the low at 93.79 suggests a strong buying interest. A move towards the resistance area between 102.59 and 103.74 is likely to occur before mid-July (upper house elections).

Await fresh signal.

USD/CHF

Moving higher.

-

USD/CHF has surged higher for the last two sessions. The resistance at 0.9625 has been broken. A key resistance lies at 0.9791. Hourly supports can be found at 0.9608 (intraday low) and 0.9546 (intraday low, see also the low of the rising channel).

-

In the longer-tern, a medium-term sideways move between the key supports at 0.9022 (01/02/2013 low) and 0.8931 (24/02/2012 low) and the key resistances at 0.9972 (24/07/2012 high) and 1.0067 (01/12/2010 high) is expected. The new phase of strength underway has been confirmed by the break of the resistance at 0.9521.

Await fresh signal.

USD/CAD

The resistance at 1.0556 has been broken.

-

USD/CAD has broken the key resistance at 1.0556. However, another strong resistance lies at 1.0658. Hourly supports are at 1.0512 (05/07/2013 low) and 1.0472 (04/07/2013 low).

-

In the longer-term, the technical improvements call for a test of the key resistance at 1.0870 (02/11/2009 high, see also the long-term declining trendline from the October 2002 peak). We favour a medium-term bullish bias as long as the support at 1.0137 (14/06/2013 low, see also the rising trendline from 0.9633 (14/09/2012 low) in a daily chart) holds. An initial key support lies at 1.0424 (27/06/2013 low).

Await fresh signal.

AUD/USD

Challenging its recent lows.

-

AUD/USD continues to remain volatile with its downward trend. Monitor the test of the support at 0.9037. Hourly resistances can be found at 0.9190 (03/07/2013 high) and 0.9253 (01/07/2013 high).

-

In the medium-term, the break of the strong support at 0.9388 (04/10/2011 low) opens the way for a further medium-term decline. The break to the downside out of the long-term symmetrical triangle (see the daily chart) suggests a move towards 0.8236. Key supports are at 0.8771 and 0.8067. A significant resistance now lies at 0.9345 (26/06/2013 high).

Sell stop 3 at 0.9033, Objs: 0.8987/0.8820/0.8332, Stop: 0.9079.

GBP/JPY

Bouncing.

-

GBP/JPY has broken the support at 151.26 and its short-term rising trendline. Monitor the support at 149.26. Hourly resistances can be found at 151.26 (previous support) and 153.02.

-

In the longer-term, we favour a further rise towards the strong resistance at 163.09 (07/08/2009) as long as the key support area between 146.46 (16/04/2013 low) and 145.88 (15/03/2013 high) holds. We do not expect a break of this resistance in the coming months though.

Await fresh signal.

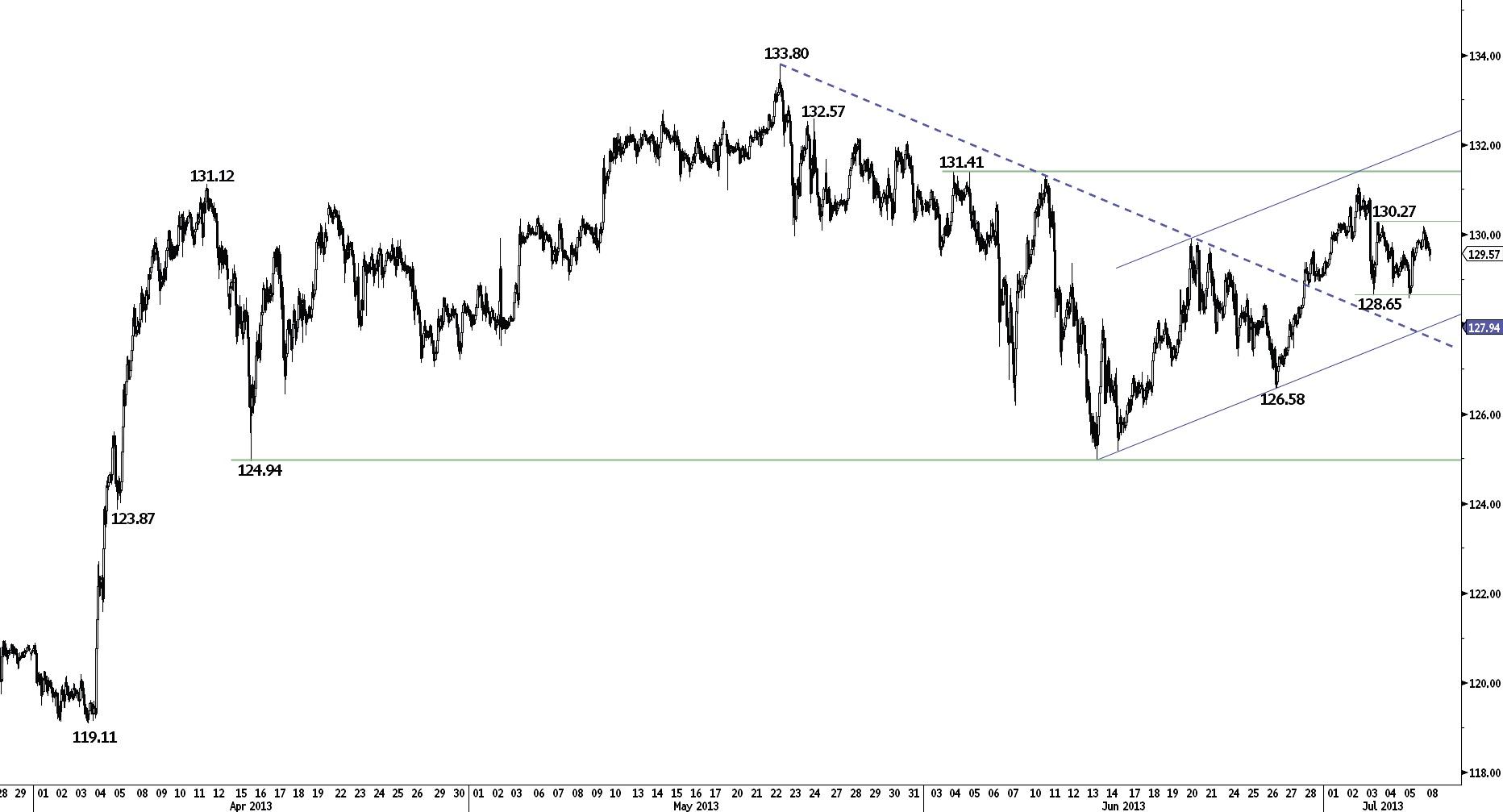

EUR/JPY

Moving sideways.

-

EUR/JPY has thus far failed to break the key resistance at 131.41. Monitor the hourly range between the support at 128.65 and the resistance at 130.27. • Monitor the horizontal range between 124.94 and 133.80. A failure to break the resistance at 131.41 could indicate a potential medium-term bearish head and shoulders formation.

-

In the longer-term, we favour a further rise towards the strong resistance at 139.22 (05/06/2009 high) as long as the support at 124.94 (16/04/2013 low) holds. We do not expect a break of this resistance in the coming months though.

Await fresh signal.

EUR/GBP

Challenging the strong resistance at 0.8637.

-

EUR/GBP has broken the resistance at 0.8599 and is challenging the strong resistance at 0.8637 (17/04/2013 high). A short-term bullish bias is favoured as long as the hourly support at 0.8598 (intraday low) holds. Another support lies at 0.8561 (intraday low).

-

From a longer-term perspective, the recent inability to make any significant new lows below the support at 0.8411 and the break of the shortterm declining trendline favour a base formation. Despite the successful test of the resistance at 0.8637 (17/04/2013 high), the succession of higher lows since April favours a bullish bias.

Buy stop 3 at 0.8641, Objs: 0.8675/0.8776/0.8990, Stop: 0.8607.

EUR/CHF

Grinding higher.

-

EUR/CHF has bounced near its support at 1.2284. We continue to see the recent price action as a base formation. The hourly resistance at 1.2383 is challenged. Another resistance lies at 1.2430. Hourly supports can be found at 1.2334 and 1.2284.

-

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the medium-term. We generally favour further longer-term upside for EUR/CHF towards the psychological threshold at 1.30.

Long 3 at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

GOLD

Weakening.

-

Gold's bounce is fading near the hourly resistance at 1269. The hourly supports at 1237 (03/07/2013 low) and 1226 (01/07/2013 low) have been broken. Supports are now at 1209 (05/07/2013 low) and 1181. An hourly resistance can be found at 1244 (intraday high, see also the hourly declining trendline).

-

In the longer-term, we favour a bearish bias as long as a capitulation or a proper base formation has not occurred. A long-term downside risk is likely given by the key support area between 1045 (05/02/2010 low) and 1027 (29/10/2009 low). A first support is given by 1157 (28/07/2012 low).

Await fresh signal.

SILVER

Drifting lower.

-

Silver's bounce is fading. Supports can be found at 18.72 (05/07/2013 low) and 18.23. Hourly resistances are at 19.42 (intraday high) and 19.94 (03/07/2013 high).

-

In the medium-term, the downside risk implied by the break of the strong support at 26.07 (26/09/2011 low) is 18.13. A key support can be found at 17.06 (05/05/2010 low).

Await fresh signal.

No information published constitutes an offer or recommendation, to buy or sell any investment instrument, to any transactions, or to conclude any legal act of any kind whatsoever. The information published and opinions expressed are provided by MIG BANK for personal use and for purposes only and are subject to change without notice. MIG BANK makes no representations (either expressed or implied) that the information and opinions expressed are accurate, complete or up to date. In particular, nothing contained constitutes financial, legal, tax or other advice, nor should any investment or any other decisions be made solely based on the content. You should obtain advice from a qualified expert before making any investment decision. All opinion is based upon sources that MIG BANK believes to be reliable but they have no guarantees that this is the case. Therefore, whilst every effort is made to ensure that the content is accurate and complete, MIG BANK makes no such claim. MIG BANK disclaims, without limitation, all liability for any loss or damage of any kind, including any direct, indirect or consequential damages. MIG BANK and/or its board of directors, executive management and employees may have or have had interests or positions on, relevant securities. All material produced is copyright to MIG BANK and may not be copied, e-mailed, faxed or distributed without the express permission of MIG BANK.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.