EUR/USD

Intraday bearish reversal near the resistance at 1.3202.

EUR/USD moved above the resistance at 1.3202 (16/04/2013 high) yesterday but failed to close above it, puting in place an intraday bearish reversal. An hourly support is at 1.3121 (intraday high) and 1.3055 (30/04/2013 low). An hourly resistance lies now at 1.3243 (01/05/2013 high).

The ECB is widely expected to cut rates today.

In the longer-term, a significant top has likely been made at 1.3711 (01/02/2013 high). Therefore, the recent rise from 1.2746 (04/04/2013 low) is seen as a rebound within an underlying downtrend. A key resistance is at 1.3319 (25/02/2013 high).

Await fresh signal.

GBP/USD

Grinding higher.

GBP/USD has moved above its resistance at 1.5550 (15/02/2013 high). Another resistance is at 1.5689. Hourly supports can be found at 1.5524 (intraday low, see also the hourly rising trendline) and 1.5468 (30/04/2013 low).

The short-term overbought conditions and the resistance area between 1.5550 and 1.5689 favour a limited short-term upside potential.

In the longer-term, the break of the horizontal range defined by the strong support at 1.5235 (13/01/2012 low) and the strong resistance at 1.6302 (30/04/2012 high) calls for a further medium-term decline. Therefore, the recent rise is still viewed as a rebound. A key resistance can be found at 1.5689 (13/02/2013 high, see also 200 day moving average).

Await fresh signal.

USD/JPY

Drifting lower.

USD/JPY continues to weaken since its failed attempt to break the key resistance at 99.94 (11/04/2013 high). A break of the hourly support at 97.01 would call for a further decline towards the key support at 95.77. Hourly resistances can be found at 97.79 (intraday high) and 98.33.

In the longer-term, the strong resistance area between 100.00 and 101.45 (06/04/2009 high) has led to a consolidation phase. However, as long as the support at 95.77 (05/04/2013 low) holds, further long-term strength towards 110.66 (15/08/2008 high) is expected.

Buy stop 3 at 100.14, Objs: 101.00/105.45/109.87, Stop: 99.28.

USD/CHF

Bouncing.

USD/CHF has moved below the support at 0.9277, but has managed to make a small base at 0.9247. Monitor the hourly resistance at 0.9314 (see also the declining trendline). Another resistance can be found at 0.9384, whereas another support lies at 0.9207.

In the longer-term, we do not expect to see a break of the support area between 0.9022 (01/02/2013 low) and 0.8931 (24/02/2013 low) and favour a minimum move towards the resistance at 0.9972 (24/07/2012 high).

Await fresh signal.

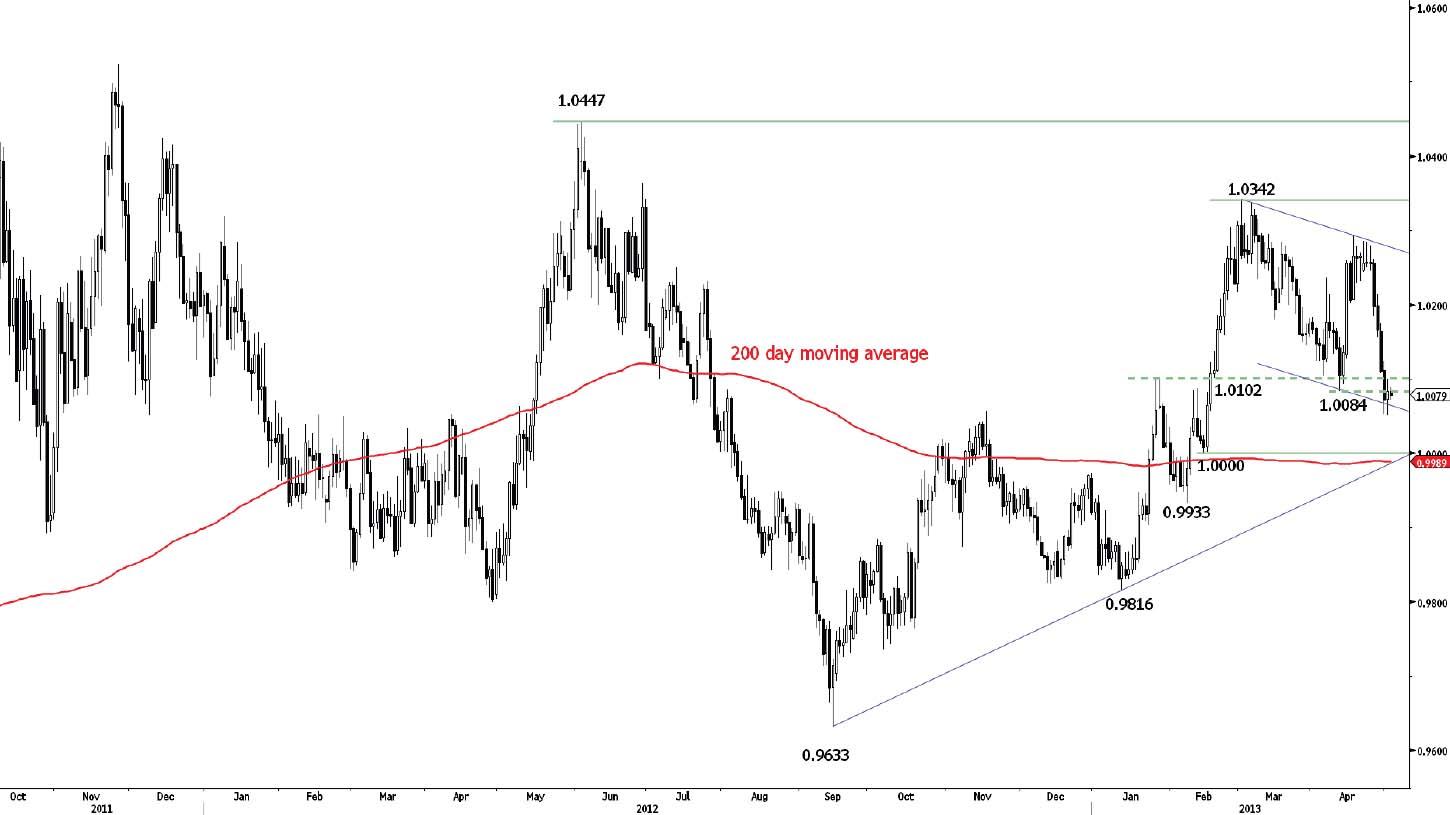

USD/CAD

Bouncing.

USD/CAD is trying to bounce after having broken the support area between 1.0102 and 1.0084. Hourly resistances can be found at 1.0124 (30/04/2013 high) and 1.0176 (intraday high). A key support can be found at 1.000 (see also the 200 day moving average and the low of the rising channel).

In the longer-term, we favour a bullish bias as long as the support at 1.0000 (14/02/2013 low, see also the rising trendline from 0.9633 (14/09/2012 low) in a daily chart) holds.

Buy limit 3 at 1.0003, Objs: 1.0079/1.0244/1.0410, Stop: 0.9927.

AUD/USD

Moving sharply lower.

AUD/USD collapsed yesterday close to its resistance at 1.0398. It is now close to its previous low and support at 1.0221. Another support is at 1.0202 (11/03/2013 low). An hourly resistance is at 1.0299.

A test of the key support area between 1.0177 and 1.0115 (04/03/2013 low) is expected as long as prices remain below the resistance at 1.0398.

In the medium-term, AUD/USD is moving within the horizontal range defined by the support at 1.0177 (25/07/2012 low) and the resistance at 1.0613 (09/08/2012 high). The direction of the break of this range is expected to give the next medium-term trend.

Sell stop 3 at 1.0198, Objs: 1.0118/0.9975/0.9591, Stop: 1.0278.

GBP/JPY

Moving sideways.

GBP/JPY has thus far failed to break its key resistance at 153.87. Monitor the horizontal range between the hourly support at 150.75 (30/04/2013 low) and the hourly resistance at 152.22 (29/04/2013 high). Another support can be found at 149.98 (23/04/2013 low).

A break of the resistance at 153.87 is needed to resume the underlying uptrend.

In the longer-term, further strength towards the key resistance at 163.09 (07/08/2009) is likely as long as the key support at 145.88 (15/03/2013 high) holds.

Buy stop 3 at 153.91, Objs: 154.91/159.87/162.98, Stop: 152.91.

EUR/JPY

Monitor the short-term declining channel.

EUR/JPY is moving within a short-term declining channel. Supports can be found at 127.06 and 126.44. Hourly resistances are at 128.93 (01/05/2013 high) and 129.99 (intraday high).

In the longer-term, EUR/JPY has moved above its key resistance at 127.92 (05/04/2010 high). Further long-term strength towards the strong resistance at 139.22 (05/06/2009 high) is likely as long as the support at 123.87 (05/04/2013 low) holds.

Await fresh signal.

EUR/GBP

Fading thus far near the resistance at 0.8497.

EUR/GBP has bounced close to the support at 0.8411 (01/04/2013 low, see also 38.2% retracement). However, as long as the resistance at 0.8497 (24/04/2013 low) is not broken, a shortterm bearish bias is favoured. The hourly support at 0.8461 (intraday low, see also the rising trendline) is challenged. Another support can be found at 0.8425 (30/04/2013 low).

From a longer-term perspective, the recent inability to make any significant new highs and the move below the support at 0.8445 (11/02/2013 low) suggest a weakening momentum. Another key support can be found at 0.8266 (16/01/2013 low, see also the mediumterm rising trendline on a daily chart). A key resistance is at 0.8637 (17/04/2013 high).

Await fresh signal.

EUR/CHF

Weakening.

EUR/CHF continues to drift lower. A support can be found at 1.2208 (22/04/2013 high). Hourly resistances are at 1.2264 (01/05/2013 high) and 1.2312 (26/04/2013 high).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the medium-term.

We generally favour further longer-term upside for EUR/CHF towards the next psychological threshold at 1.30. The recent new lows in peripheral European countries should support the EUR/CHF.

Long 3 at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

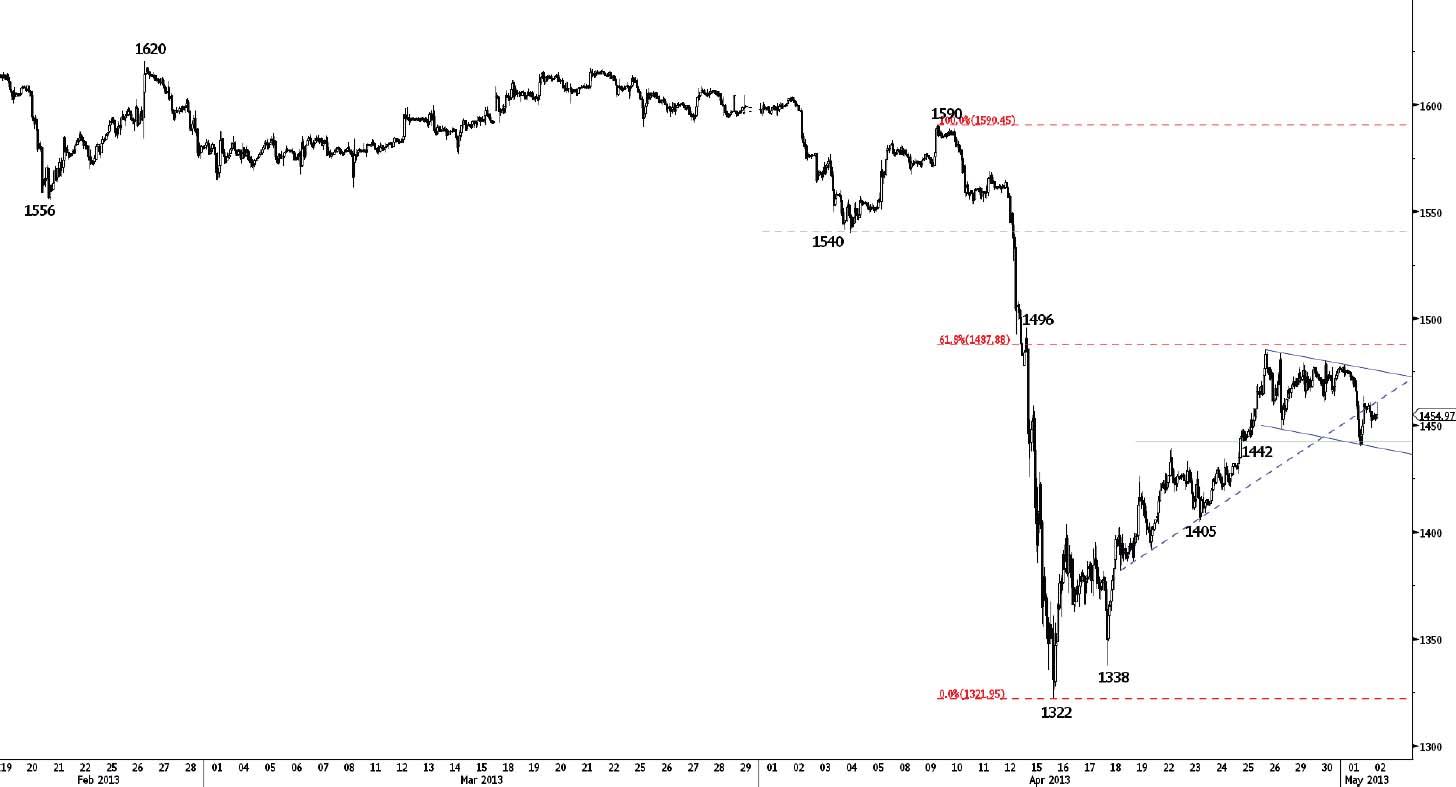

GOLD

Fading near the resistance at 1496.

Gold is fading near its resistance at 1496 (15/04/2013 high, see also 61.8% retracement). Monitor the hourly support at 1442 (see also the low of the declining channel), as a break would open the way for further declines. Another support is at 1405.

The recent rise is viewed as a rebound within an underlying downtrend.

Indeed, gold has broken to the downside out of its long-term horizontal range defined by the support at 1523 (29/12/2011 low) and the resistance at 1803 (08/11/2011 high). The implied medium-term downside risk is 1287. A key support is at 1308 (28/01/2011 low).

Sell stop 3 at 1437, Objs: 1423/1350/1210, Stop: 1451.

SILVER

Challenging the low of its rising channel.

Silver has broken its horizontal range between the support at 23.65 (26/04/2013 low) and the resistance at 24.88. However, it is still moving within its rising channel. Monitor the hourly support at 23.25. An hourly resistance can be found at 23.94 (intraday high).

The recent rise is viewed as a rebound within an underlying downtrend.

Silver has broken to the downside out of its long-term horizontal range defined by the support at 26.07 (26/09/2011 low) and the resistance at 37.48 (29/02/2012 high). The implied medium-term downside risk is 18.13. A support can be found at 19.48 (15/07/2008 high).

Sell stop 3 at 22.02, Objs: 21.83/20.33/18.03, Stop: 22.21.

No information published constitutes an offer or recommendation, to buy or sell any investment instrument, to any transactions, or to conclude any legal act of any kind whatsoever. The information published and opinions expressed are provided by MIG BANK for personal use and for purposes only and are subject to change without notice. MIG BANK makes no representations (either expressed or implied) that the information and opinions expressed are accurate, complete or up to date. In particular, nothing contained constitutes financial, legal, tax or other advice, nor should any investment or any other decisions be made solely based on the content. You should obtain advice from a qualified expert before making any investment decision. All opinion is based upon sources that MIG BANK believes to be reliable but they have no guarantees that this is the case. Therefore, whilst every effort is made to ensure that the content is accurate and complete, MIG BANK makes no such claim. MIG BANK disclaims, without limitation, all liability for any loss or damage of any kind, including any direct, indirect or consequential damages. MIG BANK and/or its board of directors, executive management and employees may have or have had interests or positions on, relevant securities. All material produced is copyright to MIG BANK and may not be copied, e-mailed, faxed or distributed without the express permission of MIG BANK.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.