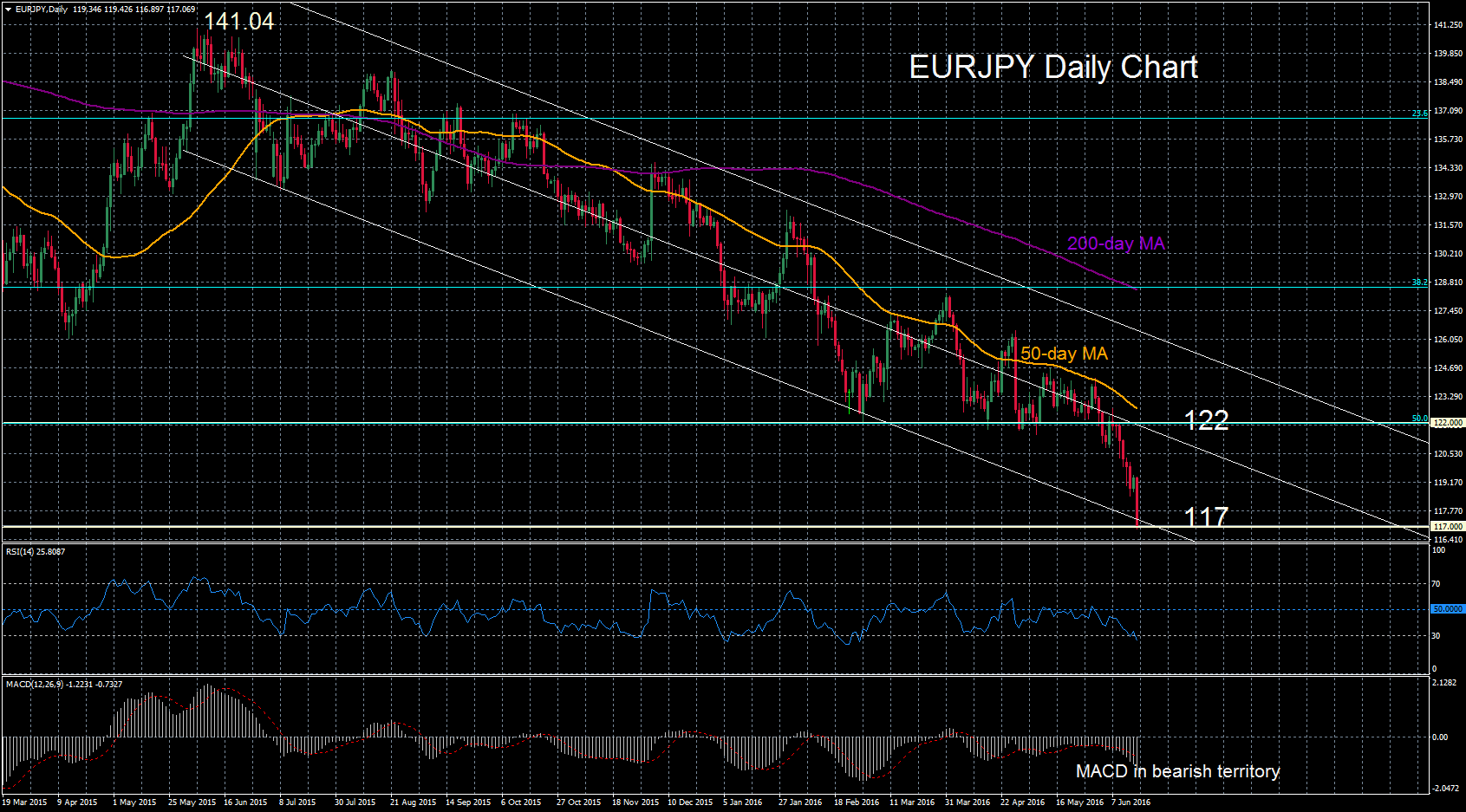

EUR/JPY dropped to a new three-year low of 116.95 this morning. The long term trend has been clearly bearish since a year ago when prices started falling from the June 2015 peak of 141.04.

The technicals are supporting a bearish bias as the 50-day moving average is below the 200-day moving average and both lines are falling. MACD is below zero in bearish territory.

Currently the pair is testing the key 117.00 level. If there is a daily close below this, prices would target the 61.8% Fibonacci retracement level of the upleg from 94.09 to 149.76 at 115.35.

Strong resistance lies at the 50% Fibonacci level at of 122.00 and the market would have to move back above this level in order to weaken the bearish bias.

In the short term EURJPY may consolidate and pause its decline since RSI has reached oversold levels and is now below 30.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.