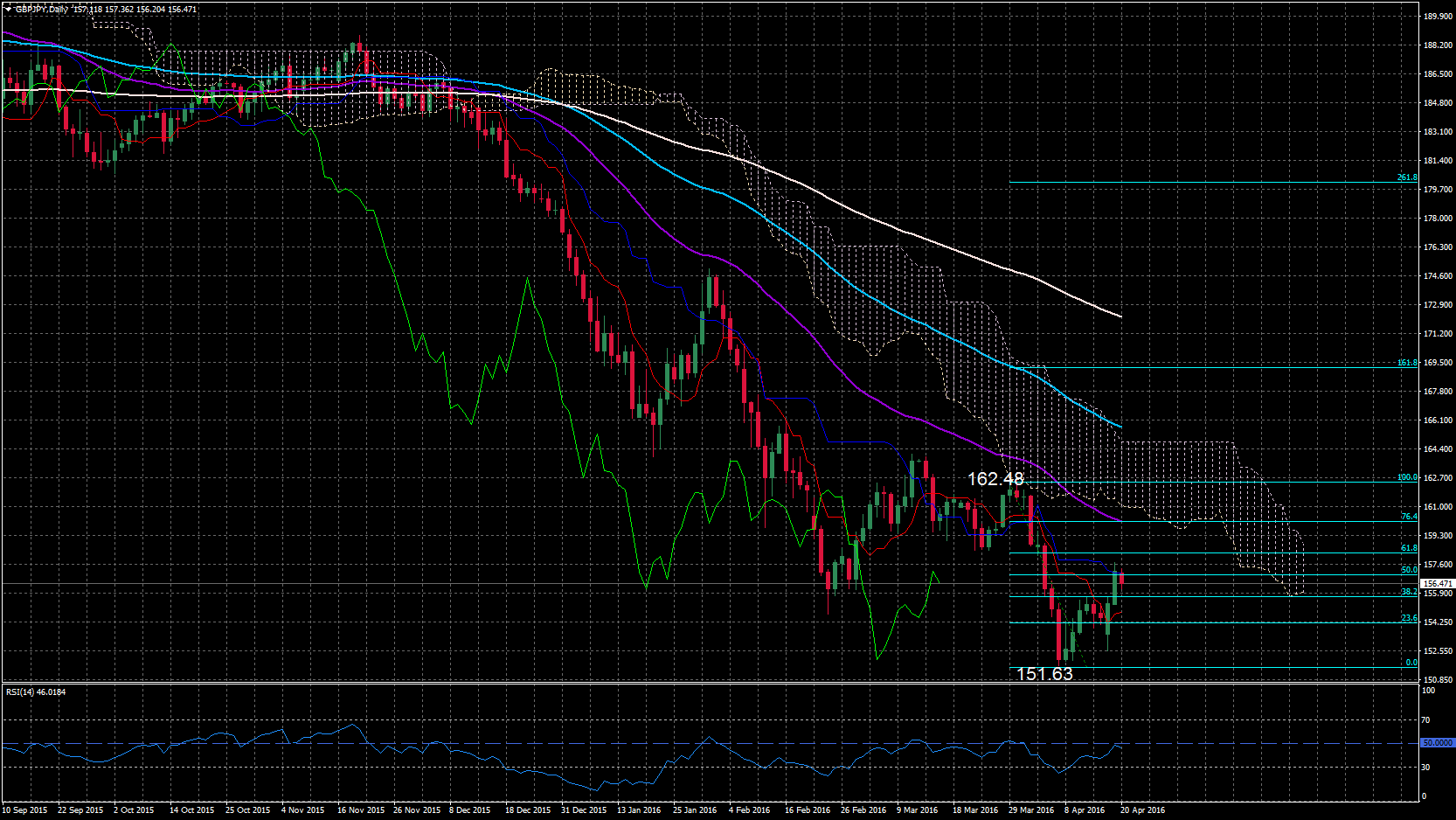

GBPJPY maintains a bearish outlook near the lowest levels since August 2013. The pair has been falling sharply since November 2015, making lower highs and lower lows until reaching 151.63.

The thick Ichimoku cloud above the market will likely cap any gains. Prices tested the 50% Fibonacci retracement at 157.00 on Tuesday before turning back down. This is the retracement of the downleg from 162.48 to 151.63 (March 29 to April 7 decline). The tenkan-sen and kijun-sen lines are negative aligned, suggesting the recent bounce from 151.63 should be viewed as a corrective bounce. The RSI is below 50 in bearish territory which also indicates that any gains are likely to run out of momentum in the short term.

Important support lies at 151.63, which if broken, could see a resumption of the downtrend that started in November 2015. The 157.00 level (50% Fibonacci) remains a key immediate resistance level.

All three moving averages are falling, which also highlight the underlying bearish market structure.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.