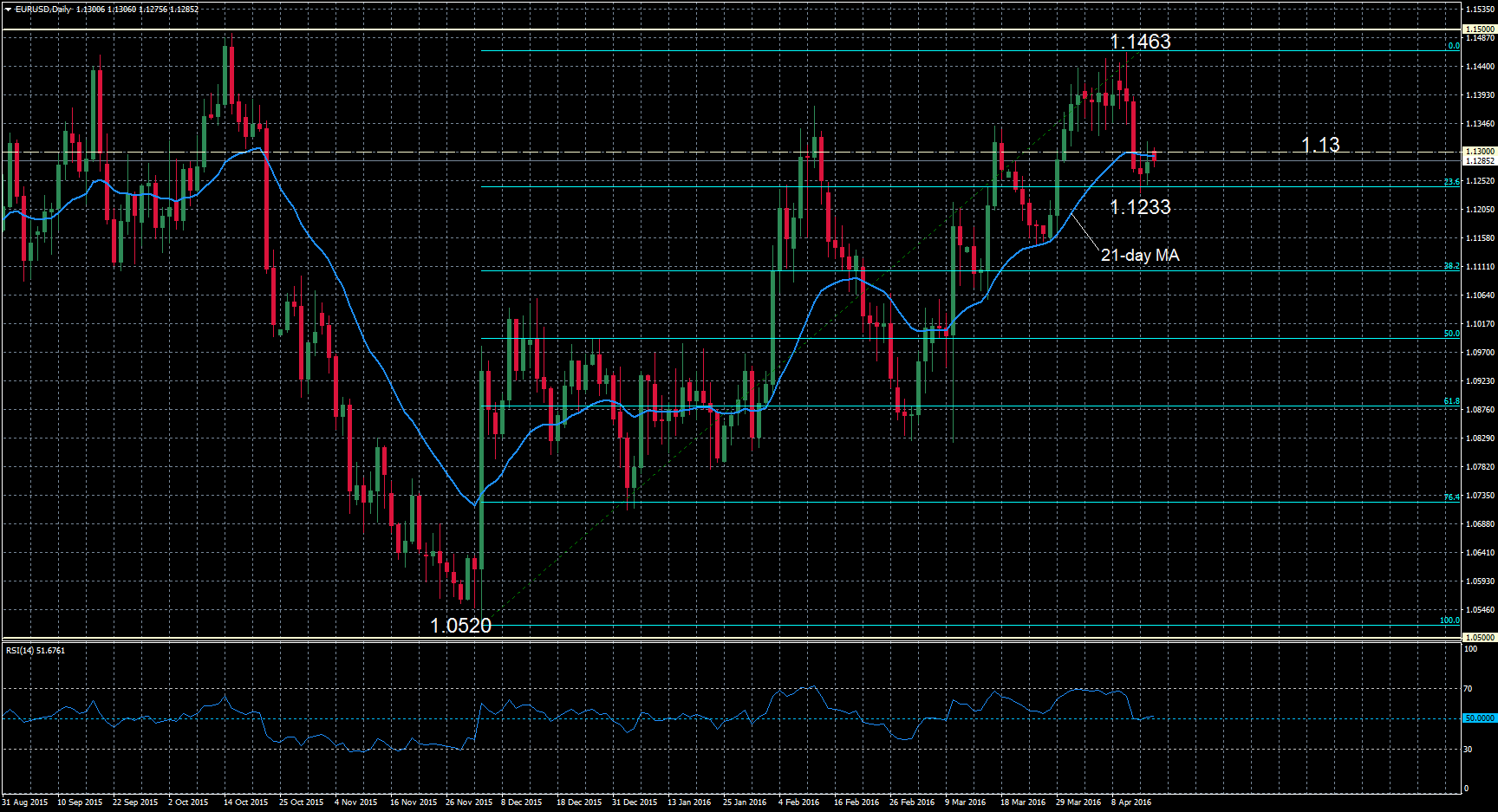

EURUSD reversed lower after reaching the highest level in six months last week, when it touched 1.1463. Prices found support at 1.1233 – which is around the 23.6% Fibonacci retracement level of the 1.0520 to 1.1463 upleg (December 2015 to April 2016 rise). RSI has fallen to test the 50 level, suggesting the stronger downside momentum.

The break below the key 1.13 level which coincides with the 21-day moving average, strengthened the bearish view. Failure to close above 1.13 would increase the chance of another leg lower and open the way for a test of the 38.2% Fibonacci at 1.1102. A further decline to the 50% Fibonacci at 1.0991 would weaken the recent short term bullish trend of the past four months.

To the upside, resistance lies at the April 12 high of 1.1463. A move above this peak would see a resumption of the uptrend with scope to target the October 2015 high of 1.1483.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.