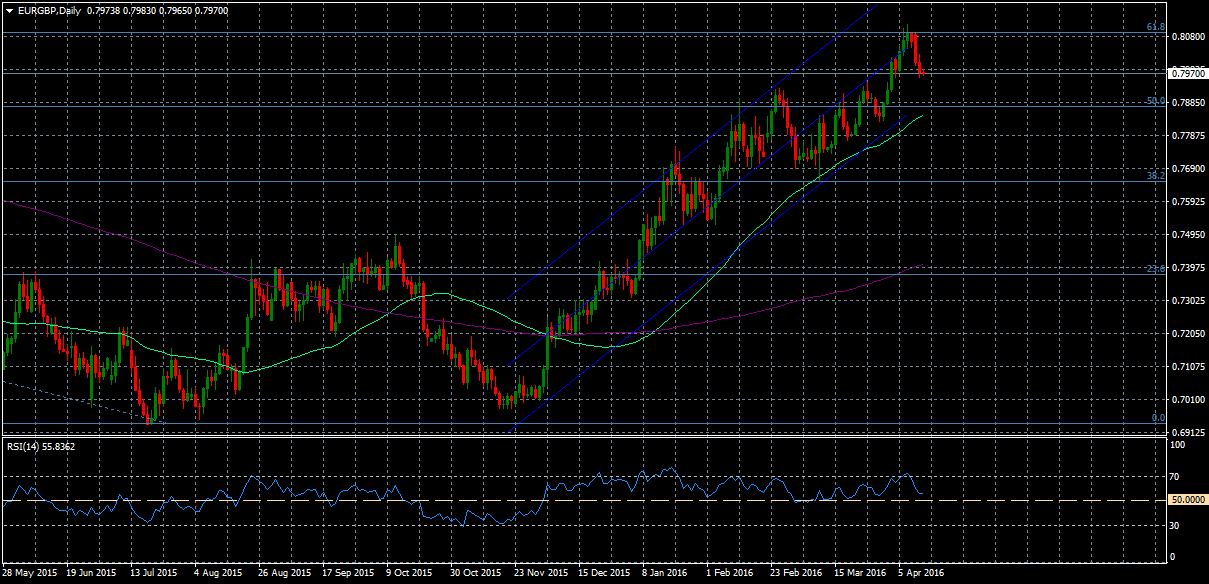

EURGBP has staged a strong rally from the November 2015 lows of 0.6981 to rise in an ascending channel to reach a high of 0.8116 last week on April 7. Prices have since reversed lower after failing to close above a key level at 0.8091.

This is the 61.8% Fibonacci retracement level of the downleg from 0.8813 to 0.6935 (February 2013 to July 2015 decline). This has acted as a strong resistance level that was tested a few times until prices lost momentum and fell to 0.7960 on Tuesday and are currently consolidating around this level. Prices would have to rise back above 0.8000 to maintain the bullish trend.

The market turned lower after reaching overbought conditions as indicated by RSI which breached the 70 level. The next target to the downside is the 50% Fibonacci at 0.7872. A break below this would shift the bullish bias that was in place since November 2015. A fall below the 23.6% Fibo level at 0.7378 would bring the pair into a neutral bias as long as prices remain above 0.6935.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.