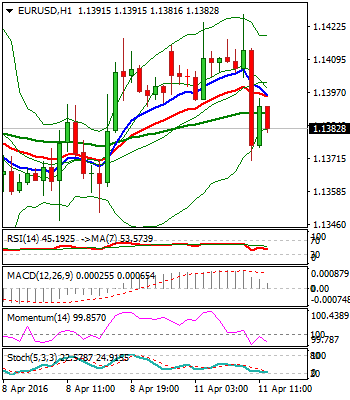

EURUSD

The Euro remains within 1.1325/1.1452 congestion, which extends in the seventh consecutive day. Strong indecision was confirmed by weekly long-legged Doji candle, as the pair remains unable to break above fresh 2016 peak, which was posted on brief attempt above near-term congestion tops.

Daily MA’s turned into full bullish setup and favor fresh upside attempts, which require sustained break higher, to open next significant barrier at 1.1494 (15 Oct 2015 peak).

Rising daily 10 SMA / Tenkan-sen offer initial support at 1.1370, also session low, head of 1.1337 (Fibo 38.2% of 1.1151/1.1452 upleg) and congestion floor at 1.1325, above which, dips should be contained.

Otherwise, violation of 1.1325/00 support zone, would trigger stronger correction of 1.1151/1.1452 upleg, which was signaled by repeated upside rejections during last week.

Res: 1.1436; 1.1452; 1.1465; 1.1494

Sup: 1.1370; 1.1337; 1.1325; 1.1300

GBPUSD

Cable eventually penetrated daily cloud base at 1.4145, which capped the action during past few days. Upside action was signaled by Friday’s bullish Outside Day, with fresh bullish acceleration extending near strong resistance zone at 1.4225/40, which consists of daily 20 SMA and Tenkan-sen line. Sustained break here would open next pivotal barrier at 1.4258 (daily Kijun-sen line), followed by 1.4284 (Fibo 61.8% of 1.4457/1.4004 downleg).

Daily Slow Stochastic reversed from oversold territory and shows enough room upside for extended correction, with violation of 1.4258/84 barriers, needed to sideline downside threats, in favor of stronger correction.

Res: 1.4230; 1.4258; 1.4285; 1.4350

Sup: 1.4145; 1.4090; 1.4050; 1.4038

USDJPY

The pair hit fresh low at 107.61 today, following n/t recovery rejection at 109.08 last Friday. Strong downside pressure was shaped in long bearish weekly candle. Which suggests bearish resumption towards psychological 107.00 support and 106.70 (Fibo 76.4% of 100.81/125.84 (May 2004 / May 2015 rally).

Meantime, corrective rallies should be ideally capped by hourly cloud base at 108.50, before fresh push lower.

Pivotal barrier lies at 109.08 (Friday’s high / hourly cloud top) and only sustained break here would sideline immediate bears, for possible extension towards key near-term barriers at 110.00 (psychological resistance) and 110.50/65 (daily 10SMA / former consolidation range floor).

Res: 108.30; 109.08; 109.35; 110.00

Sup: 108.00; 107.61; 107.00; 106.70

AUDUSD

Aussie trades in near-term sideways mode, holding within hourly Ichimoku cloud, as near-term action from late Friday until current, is entrenched within 0.7577/0.7526 range.

This could be seen as a part of larger consolidation under fresh high at 0.772, which so far based at 0.7475.

Overall bullish stance is fading, as the pair broke below daily 10 & 20 SMA’s, with south-turning daily indicators, keeping in play scenario of deeper correction of 0.6826/0.7721 upleg, on loss of 0.7475 handle, which may trigger 100-pips bearish extension towards 0.7379 (Fibo 38.2% of 0.6826/0.7721).

Broken daily 20SMA caps today’s action at 0.7575, followed by 10SMA at 0.7596, while only break above lower platform at 0.7630 zone will neutralize existing downside threats.

Res: 0.7575; 0.7596; 0.7675; 0.7721

Sup: 0.7526; 0.7490; 0.7475; 0.7412

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold price shines amid fears of fresh escalation in Middle East tensions

Gold price rebounds to $2,380 in Thursday’s European session after posting losses on Wednesday. The precious metal holds gains amid fears that Middle East tensions could worsen and spread beyond Gaza if Israel responds brutally to Iran.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.