EURUSD

The Euro stabilizes above yesterday’s low at 1.1126, where Fibonacci 38.2% of 1.0709/1.1374 rally, also the lower boundary of strong 1.1160/20 support zone, contained two-day pullback.

Consolidation remains capped by initial barrier at 1.1200 for now, however, attempt above and stretch to the breakpoint 1.1225, Fibonacci 38.2% of 1.1374/1.1126 downleg, cannot be ruled out.

Sustained break above 1.1225 is needed to signal near-term base and trigger stronger retracement of 1.0709/1.1374 downleg, towards 1.1250 and 1.1280, 50% and 61.8% retracement, respectively.

Otherwise, downside will remain vulnerable, as near-term studies are soft and bias turned lower on yesterday’s dovish comments of ECB’s Draghi.

Loss of 1.1120/00 support zone will signal further weakness and expose pivotal support at 1.1055, 200SMA.

Res: 1.1200; 1.1225; 1.1250; 1.1279

Sup: 1.1144; 1.1120; 1.1075; 1.1055

GBPUSD

Cable probed above 1.45 handle, on today’s fresh rally that emerged after repeated failure to clearly break below 1.4441 support, Fibonacci 38.2% of 1.4078/1.4665upleg.

Rally was so far short-lived and capped by sideways-moving daily 10SMA, which marks the upper limit of narrower range, established between daily 30SMA at 1.4403 at the downside and 10SMA at 1.4500, at the upside.Today’s price action holds within this range for now, as quick pullback from session high at 1.4514, sidelined hopes of eventual attack at 1.4576 pivot, top of near-term congestion.Mixed setup of daily MA’s suggests extended sideways trade, however, bearishly aligned daily indicators and soft near-term studies, keep the downside vulnerable.

Cracked Fibonacci 38.2% support at 1.4441 and daily 30SMA at 1.4403, remain as downside pivots and sustained break lower will re-open key support at 1.4350,08 Feb low.

Res: 1.4494; 1.4514; 1.4576; 1.4612

Sup: 1.4441; 1.4403; 1.4380; 1.4350

USDCAD

The pair returns to firm bearish mode, following yesterday’s break and close below 10SMA, which currently lies at 1.3854.

Today’s fresh weakness that extends below 1.3781, Fibonacci 61.8% of 1.3637/1.4014 upleg, signals an end of corrective phase and focuses key supports, daily Ichimoku cloud base / former low of 04 Feb at 1.3675/37, as fresh bearish acceleration dipped to psychological 1.3700 support.

Sustained break below 1.3637 to signal fresh bearish extension of larger pullback from 1.4688 and expose next support at 1.3589, daily 100SMA.

Meantime, corrective rallies are seen as positioning for fresh attempts lower, with hesitation on approach to 1.3675/37 pivots to be anticipated, as daily Slow Stochastic is approaching oversold territory.

Only return and close above 10SMA would sideline immediate downside threats and signal prolonged consolidation.

Res: 1.3881; 1.3919; 1.3962; 1.4014

Sup : 1.3795, 1.3781; 1.3726; 1.3707

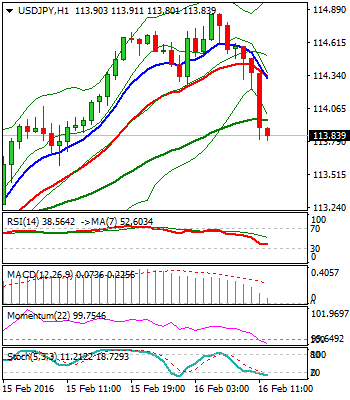

USDJPY

Two-day correction extended to fresh high at 114.85 today and is so far capped by falling daily 10SMA, which guards pivot at 115.06, Fibonacci 38.2% retracement of sharp 121.67/110.97 fall.

Subsequent pullback is looking for 113.30 support zone, Fibonacci 38.2% of 110.97/114.85 upleg / top of thick hourly Ichimoku cloud, where dips should be ideally contained, to keep freshly established hourly bulls in play, for renewed attempt at 115.06 breakpoint.

Otherwise, initial signal of recovery stall will be generated on sustained break below 113.30 pivot.

Next downside breakpoint lies at 112.50, hourly Ichimoku cloud base / Fibonacci 61.8% retracement.

Res: 114.27; 114.85; 115.06; 115.95

Sup: 113.58; 113.30; 112.90; 112.50

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.