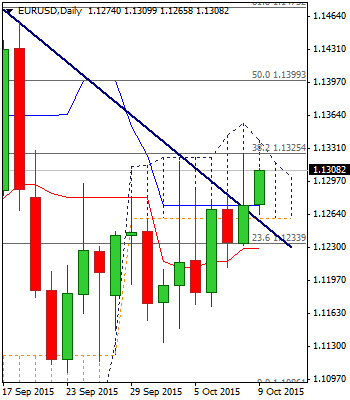

EURUSD

The Euro moves within the daily cloud, which was penetrated again yesterday, with daily close above the cloud base. Rallies were limited at 1.1325, double-Fibonacci barrier (38.2% of 1.1712/1.1086 and 61.8% of 1.1458/1.1103 downleg, also weekly Ichimoku cloud base, which marks pivotal resistance zone with 1.1339, daily cloud top. Sustained break here is needed to spark fresh bulls and expose next key barrier at 1.1458, 18 Sep peak.

Near-term studies are bullish, with daily indicators establishing in the positive territory and supporting fresh gains. Also, the pair is on track for strong weekly close.

Daily cloud base at 1.1260, along with broken-bear-trendline, connecting 1.1712 and 1.1458 tops, at 1.1250 and daily 20SMA at 1.1242, marks strong support zone, which is expected to ideally contain dips and keep the upside in near-term focus.

Res: 1.1325; 1.1339; 1.1400; 1.1458

Sup: 1.1260; 1.1242; 1.1229; 1.1210

GBPUSD

Cable eventually closed above very strong 1.5300/15 resistance zone, after yesterday’s bumpy ride, which moved within 110-pips span, falling from 1.5370 to 1.5260 and fully reversing losses, on recovery rally. Near-term price action consolidates, after meeting target at 1.5380, 50% retracement of 1.5656/1.5105 downleg / daily Kijun-sen line, with bullish daily studies, looking for further upside. Former barrier at 1.5315, 200SMA / bull-trendline, connecting 1.4563/1.5163 lows, offers strong support, followed by daily 20SMA and this support zone is expected to contain dips, for fresh bullish attempts. Lift above 1.5380 and 1.5400, round-figure barrier, to open next target at 1.5436/46 area, daily 55SMA / Fibonacci 61.8% of 1.5656/1.5105 downleg.

The pair is on track for strong weekly close that comes after previous week’s tight Doji and gives strong bullish signal.

Res: 1.5381; 1.5400; 1.5446; 1.5500

Sup: 1.5340; 1.5315; 1.5300; 1.5260

USDJPY

The pair remains within narrow range and near-term price action holding in the triangle and being capped by thin 120.20/120.70 daily Ichimoku cloud. Yesterday’s Doji confirmed indecision, as triangle boundaries are continuing to contract. Near-term technicals remain in neutral mode, while daily studies are negatively aligned. Sustained break above daily cloud and regain of 200SMA at 120.86, are needed to revive bulls and neutralize bearish scenario, which requires slide below triangle support at 119.64 and violation of 119 zone, short-term congestion floor.

Res: 120.25; 120.55; 120.70; 120.86

Sup: 119.82; 119.64; 119.23; 119.05

AUDUSD

Aussie hit 6 ½ week high, with fresh acceleration of near-term uptrend from 0.6935 base, being supported dovish Fed and rally in commodities. The pair eventually broke above key barrier at 0.7278, 17/18 Sep former tops, approaching initial target at 0.7310, Fibonacci 76.4% of 0.7435/0.6906 descend, with extension towards next strong barrier, daily Ichimoku cloud top at 0.7375, not ruled out.

The notion is supported by weekly gains of 3.2%, with the pair being on track for strong bullish weekly close, which will signal reversal.

Firmly bullish technicals on all timeframes, may be interrupted by corrective actions on overbought conditions. Dips should be ideally contained above daily Ichimoku cloud base, which lies at 0.7176, being reinforced by daily 55SMA

Res: 0.7310; 0.7375; 0.7409; 0.7490

Sup: 0.7245; 0.7200; 0.7176; 0.7120

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.