EURUSD extends lower on two-day corrective pullback from 1.1288, with fresh extension below initial 1.1173 support, being initially contained by daily Ichimoku cloud base at 1.1121. The move is seen as corrective phase of larger uptrend, as daily technicals hold bullish setup. On lower timeframes, hourly studies are negative, with 4-hour indicators heading south and allowing for further easing, before bulls re-assert. Next supports lay at 1.1109/1.1070, Fibonacci 38.2% retracement of 1.0818/1.1288 upleg / 29/30 Apr higher base, below which, extended dips should ideally reverse at 1.10 zone, ascending daily 10SMA / double-Fibonacci support, 38.2% retracement of entire1.0519/1.1288 rally and 61.8% retracement of 1.0818/1.1288 upleg. Overall bullish structure keeps upside in focus, with penetration of 1.1288 barrier, to open next targets at 1.1387, Fibonacci 38.2% retracement of larger 1.2884/1.0461 descend and pivotal 1.1449, lower top of 19 Feb. Conversely, extension and close below daily 10SMA, would soften the structure and trigger further easing.

Res: 1.1188; 1.1223; 1.1288; 1.1330

Sup: 1.1070; 1.1053; 1.1000; 1.0950

GBPUSD

Cable remains under pressure in the near-term, with yesterday’s fresh weakness ending day in red again and probing below pivotal 1.51 support zone, where daily Ichimoku cloud and Fibonacci 61.8% retracement of 1.4854/1.5496 upleg lies. Descend found temporary support here, with near-term consolidative phase under way. Negatively aligned near-term technicals see risk of further easing that will be looking for another pivotal support at 1.5000, psychological support, reinforced by ascending daily 20SMA, also near daily Ichimoku cloud base, loss of which to neutralize daily bulls. Current consolidation is capped by daily 100SMA at 1.5152, with break here and acceleration above 1.52, daily 10SMA, required to give initial signals of reversal.

Res: 1.5152; 1.5200; 1.5245; 1.5300

Sup: 1.5090; 1.5030; 1.5000; 1.4974

USDJPY

The pair trades in near-term consolidative phase under yesterday’s fresh high at 120.27, with 1.20 zone, previous pivotal barrier, also daily Ichimoku cloud top, keeping the downside protected for now. Hourly neutral tone favors further sideways trading, while 4-hour studies maintain bullish setup and see scope for further ascend, after 120 breakpoint was taken out. Also, daily studies are building bullish momentum that would encourage for final push towards key barrier at 120.83, 13 Apr high and top of short-term range, final break of which is required to end short-term directionless phase and focus key peak at 122.01. Alternatively, reversal under 120 handle would risk extension to the pivotal, sideway’s moving daily 20SMA at 119.54, close below which would signal false break higher and confirm extended range-trading.

Res: 120.27; 120.46; 120.67; 120.83

Sup: 120.00; 118.80; 119.54; 119.25

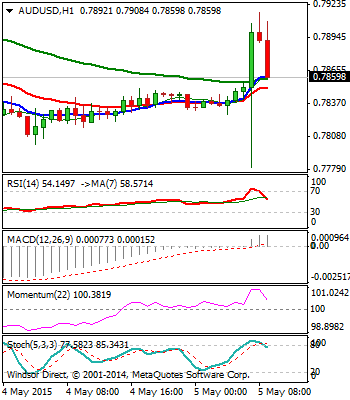

AUDUSD

Aussie trades in choppy near-term mode, after RBA’s rate cut. Yesterday’s Doji signals indecision, with hopes of reversal still in play, despite overnight’s short-lived crack of 0.78 handle that was contained by ascending daily 20SMA. Today’s rallies probed above daily Ichimoku cloud top at 0.7906, with daily close above daily 10SMA, currently at 0.7867, seen as minimum requirement to signal reversal. Extension above 0.79 barrier, to confirm. Bullish daily studies support the notion. Conversely, renewed attempts below 0.78 and loss of daily 20SMA, to confirm extension of reversal from 0.8073, peak of 29 Apr.

Res: 0.7916; 0.7961; 0.8000; 0.8020

Sup: 0.7800; 0.7780; 0.7749; 0.7738

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.