EURUSD

The Euro consolidates above 1.08 zone, where yesterday’s sharp fall found footstep, guarding strong supports at 1.0790, daily 20SMA / Kijun-sen line. Upside attempts were so far limited, keeping intact initial barriers at 1.0890/1.0913, hourly cloud base / downside-reversed daily 10SMA.

Near-term studies remain weak and keep focus at the downside. Final break below 1.0790 handle to open way for further retracement of 1.0519/1.1058, with no significant supports on the way, once 1.0790 is cleared.

On the other side, daily indicators are bullishly aligned, while MA’s show mixed setup, as the price action moves within 20/100SMA’s range.

Daily slow Stochastic is oversold and suggests that bullish signals for stronger bounce could be expected.

Above daily 10SMA, next good resistance lies 1.0973, daily Ichimoku cloud base, penetration of which to neutralize near-term bears.

Res: 1.0867; 1.0890; 1.0913; 1.0973

Sup: 1.0790; 1.0765; 1.0725; 1.0700

GBPUSD

Cable corrects yesterday sharp fall that left fourth consecutive long red daily candle and fully retraced 1.4892/1.5237 upleg. The pair posted fresh low at 1.4863, where weekly bear-channel support was tested.

Corrective rallies are seen ahead of fresh attempts lower, with initial resistance at psychological 1.50 level, also Fibonacci 38.2% retracement of 1.5237/1.4863 descend. Daily 10SMA / Tenkan-sen, which lay at 1.5050, are expected to ideally cap rallies.

Renewed attempts lower will be looking for retest of 1.4830/12 Mar / July 2013 lows.

Res: 1.4951; 1.5000; 1.5050; 1.5099

Sup: 1.4928; 1.4863; 1.4830; 1.4812

USDJPY

The pair dipped to 121 zone, following spike to 123.53, where rally was capped and subsequent sharp fall. Sharp bearish acceleration that was supported by low liquidity, penetrated daily Ichimoku cloud top at 121.37, but the cloud, spanned between 120.83 and 121.37, is still acting as valid support.

Bounce on oversold near-term studies could extend above initial 200SMA barrier at 121.58, with daily 20SMA at 122.50, expected to cap extended rallies.

Bearish daily studies favor further weakness. Extension below daily cloud base is needed to confirm bears and open way for full retracement of 120.33/123.53 upleg.

Alternative scenario requires close above daily 20SMA to neutralize.

Res: 121.58; 122.00; 122.50; 122.86

Sup: 121.37; 121.04; 120.83; 120.33

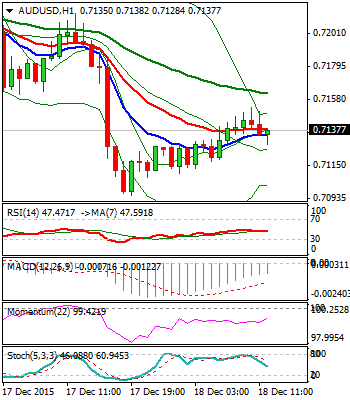

AUDUSD

Aussie consolidates yesterday’s sharp fall that eventually broke below strong 0.7155 base and left long red daily candle, on a dip below 0.7100 support. Daily bears are again fully in play, as the pair ended near-term consolidation phase and look for test of 0.7067, 18 Nov trough, ahead of key near-term supports at 0.7014, 10 Nov low and psychological 0.7000 support.

Corrective attempts were so far capped under thin daily Ichimoku cloud top at 0.7158, guarding falling daily 10SMA barrier at 0.7182.

Only return to daily high at 0.7244, reinforced by daily 20SMA, would sideline bearish threats.

Res: 0.7158; 0.7182; 0.7208; 0.7244

Sup: 0.7110; 0.7095; 0.7067; 0.7067

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.