EURUSD

The Euro slumped below former low at 1.0591, after recovery rally was stalled, followed by sharp reversal.

The pair rallied earlier today, in attempts to break above consolidation range, defined by past two days double Doji. Bulls were capped by initial barrier, daily 10SMA, at 1.0688, just under 4-hour Ichimoku cloud base and subsequent sharp fall surged through approx 60-pips thick hourly Ichimoku cloud, which did not provide any significant support.

Fresh bearish acceleration broke below psychological 1.06 support, is signaling bearish resumption of larger bear-leg from 1.1494, 15 Oct high. Daily close below 1.06 handle, to confirm break and expose next targets at 1.0519, 13 Apr low and key support at 1.0461, annual low, posted on 13 Mar 2015.

Res: 1.0591; 1.0620; 1.0636; 1.0660

Sup: 1.0554; 1.0519; 1.0495; 1.0461

GBPUSD

Cable establishes below 1.51 handle, which was the last obstacle on the way to 1.5025 and 1.5000 targets. Three consecutive days of close in red, drove the price to 1.5051 low, with near-term consolidation, seen ahead of final push lower, for full retracement of 1.5025/1.5334 upleg.

Technicals maintain firm bearish tone on all timeframes, suggesting limited upside attempts, before attacking 1.5025/00 pivots.

Session highs at 1.5112, mark initial barrier, with hourly Ichimoku cloud base at 1.5135, expected to cap.

However, extension above 1.5153, yesterday’s high, will confirm hourly double-bottom pattern and delay immediate bears, in favor of possible stronger bounce towards key 1.5193 barrier, daily Tenkan-sen line / weekly Ichimoku cloud base, .

Res: 1.5112; 1.5135; 1.5153; 1.5193

Sup: 1.5051; 1.5025; 1.5000; 1.4950

USDJPY

The pair trades between daily 20 and 10SMA’s, on bounce from 122.25 low, retested today, signaling hesitation on approach to pivotal 122.20 support, 16 Nov higher low.

Repeated attempts at 122.20 handle were contained by rising daily 20 SMA, which prevents violation of 122.20 breakpoint.

Bullishly aligned daily indicators and MA’s, support scenario of reversal and fresh acceleration higher. The notion is supported by daily slow Stochastic, which turned sideways and just above oversold territory, after steep descend.

This could be initial reversal signal, with confirmation requiring break and close above daily 10SMA, currently at 122.93, reinforced by 4-hour Ichimoku cloud base, as well as clearance of lower top at 123.24, also 4-hour cloud top.

Res: 122.93; 123.24; 123.59; 123.74

Sup: 122.56; 122.20; 121.75; 121.38

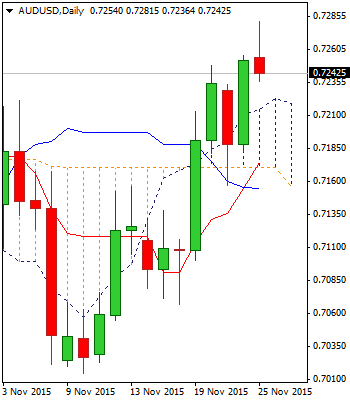

AUDUSD

Aussie regained strength and marked strong bullish close yesterday, ending two-day congestion and turning near-term focus higher again. Yesterday’s close above 0.7240, Fibonacci 61.8% of 0.7380/0.7014 downleg, generated another bullish signal. Today’s fresh extension higher approached psychological 0.73 barrier. Hesitation here could be expected and is signaled by overbought daily slow Stochastic.

However, limited downside action is expected, as daily studies are in firm bullish setup. Daily Ichimoku cloud top offers good support at 0.7222 and should act as ideal reversal point.

Only extension below 0.7200, daily 10SMA and 0.7175, daily cloud base / Tenkan-sen, would sideline upside attempts.

Res: 0.7281; 0.7300; 0.7361; 0.7380

Sup: 0.7236; 0.7215; 0.7175; 0.7150

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.