Sterling spiraled to fresh one-week low vs dollar, after dovish comments from BoE’s chief Carney, who pointed to UK borrowing costs remaining on hold until 2017.

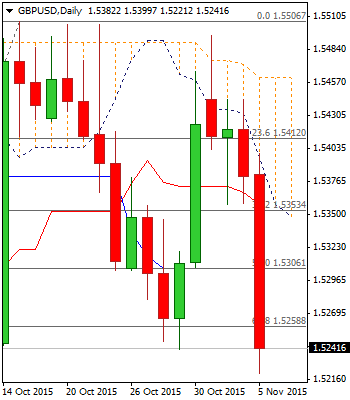

Sharp acceleration took out strong support at 1.5240, 29 Oct low, that confirmed lower platform at 1.5505, formed by several upside rejections.

Extension below 1.5240 handle, face one significant obstacle en-route to key 1.5105 support, low of 30 Sep, which lies at 1.5200, Fibonacci 76.4% of 1.5105/1.5506 upleg and 13 Oct spike low.

Daily close below 1.5258, broken Fibonacci 61.8% of 1.5105/1.5506 upleg, to confirm an end of bull phase from 1.5105 and bring the latter in full focus.

South heading daily slow Stochastic that reversed earlier on approach to oversold zone, shows more room towards the downside, as oversold near-term studies, do not show reversal signals yet.

Corrective rallies should be anticipated in the near-term, with initial barrier at 1.5311, daily 30SMA, ahead of 200SMA at 1.5339, which is seen as ideal limit. Falling daily Ichimoku cloud base that maintains the downmove and marks breakpoint, lies at 1.5396.

Res: 1.5285; 1.5311; 1.5339; 1.5396

Sup: 1.5221; 1.5200; 1.5160; 1.5105

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.