EURUSD

Yesterday’s fresh acceleration lower, took out strong support at 1.0895, which acted as near-term base and further bearish extension met next target at 1.0844, 05 Aug low.

Strong bearish signal was given on final break and close below weekly bull-trendline off 1.0461 low, also monthly bearish wedge pattern support.

Next strong support lies at 1.08 zone, multi-month consolidation low, below which there will be no significant obstacles en-route towards key med-term support at 1.046, 13 Mar low.

Near-term indicators bounced from oversold zone, triggering near-term consolidation, ahead of fresh push lower.

Falling daily 10SMA / Tenkan-sen, currently at 1.0970, maintain descend and are expected to cap extended corrective attempts.

Alternatively, reverse above bear-trendline, drawn off 1.1712 peak, which currently lies at 1.1010, would delay immediate bears, in favor of stronger correction.

Res: 1.0935; 1.0970; 1.1010; 1.1051

Sup: 1.0832; 1.0807; 1.0713; 1.0611

GBPUSD

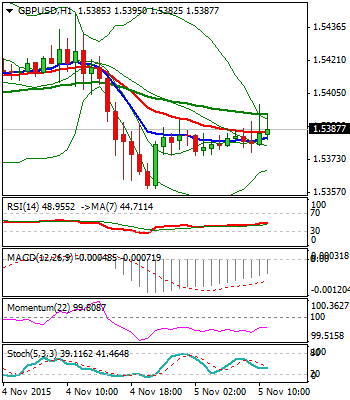

Near-term pullback from strong 1.55 resistance zone, found temporary support at 1.5358, where hourly base has formed, followed by narrow consolidation. Price action remains capped by descending daily Ichimoku cloud base, which signals further downside, while recovery attempts remain limited.

Daily slow Stochastic reversed lower and shows more room for bearish extension. Break below immediate support at 1.5376, daily 20SMA that holds today’s action and extension through 1.5358 hourly base and 1.5341, 200SMA, will be seen as a trigger for further weakness.

However, daily studies are mixed and prolonged consolidation, could be preferred near-term scenario, until the pair gains more clear signals for fresh direction.

Res: 1.5410; 1.5443; 1.5471; 1.5495

Sup: 1.5376; 1.5358; 1.5341; 1.5300

USDJPY

The pair maintains strong bullish stance, as yesterday’s acceleration higher took out initial 121.46 resistance and cracked the breakpoint at 121.64, 31 Aug peak and top of two-month congestion.

Today’s fresh extension higher that approaches psychological 122 barrier confirms bullish resumption.

Today’s close above 121.78, Fibonacci 61.8% of 125.26/116.13 descend, is required to confirm bears and expose next significant barrier at 124.14, June 2007 peak, ahead of 125.84, June 2015, year-to-date high.

Corrective actions should be contained by 200SMA at 121.07, to keep near-term bulls intact.

Res: 121.37; 121.46; 121.64; 122.00

Sup: 121.05; 120.70; 120.50; 120.24

AUDUSD

Daily studies are losing traction, following repeated upside rejection at 0.7222, mid-point of 0.7380/0.7064 downleg, where downside-turning daily 20SMA capped recovery attempt off 0.7064.

Yesterday’s red daily candle with long upper shadow, shows renewed selling pressure. The price penetrated daily Ichimoku cloud top and currently holds in the middle of daily cloud, after retracing 61.8% of 0.70640.7220 rally on dip to 0.7124.

Temporary support was found here and consolidation is expected to precede fresh attempts lower, as technicals of all timeframes are bearishly aligned.

Next pivotal support lies at 0.7100, daily cloud base, loss of which to open way for full retracement of 0.7064/0.7222.

Upside attempts are expected to hold below daily Ichimoku cloud top and maintain fresh near-term bears.

Res: 0.7154; 0.7176; 0.7214; 0.7222

Sup: 0.7124; 0.7100; 0.7064; 0.7040

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.