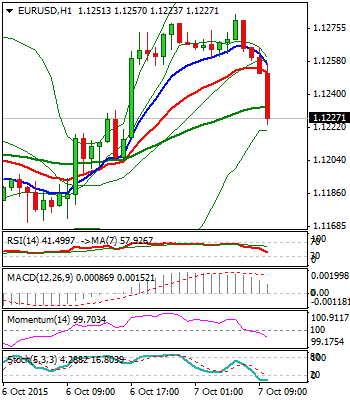

EURUSD

The Euro turned near-term focus higher on yesterday’s rally from 1.1170 low, where dips found support and left hourly higher base, guarding more significant 1.1155 support, 200SMA / bull-trendline, drawn off 1.1103, 23 Sep low. Fresh rally penetrated daily Ichimoku cloud at 1.1260, but gains were again capped by bear-trendline, off 1.1712 peak, keeping intact key barrier at 1.1335, daily cloud top.

This signals that the pair remains directionless in the near-term and is expected to trade in prolonged range, between 200SMA and daily Ichimoku cloud top. Neutral setup of daily studies, supports the notion.

Firm break of either side of the range, is required to signal fresh direction.

Res: 1.1260; 1.1288; 1.1317; 1.1335

Sup: 1.1213; 1.1205; 1.1170; 1.1155

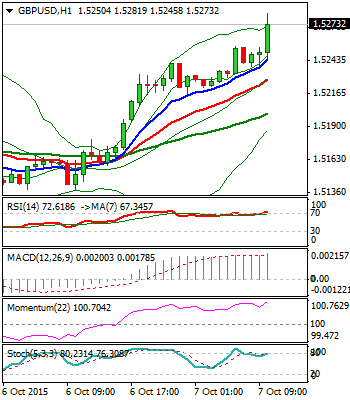

GBPUSD

Cable is gaining traction following final break above 1.5240 barrier, which were capping near-term consolidation and marking the upper boundary of 1.5105/1.5240 range. Extended correction is signaled, as near-term studies are turning bullish. However, limited upside action is seen so far, as daily structure is firmly bearish and strong resistance formed at 1.5315/28 zone, double Death Cross of 20/200 and 30/200SMA’s, also Fibonacci 38.2% of 1.5656/1.5105 descend / former lows and hourly higher base.

Rallies should be ideally capped here, to keep larger bulls intact. Conversely, sustained break higher would signal stronger recovery and expose 1.5381, Fibonacci 61.8% of 1.5656/1.5105 downleg / 4-hour Ichimoku cloud top.

Res: 1.5315; 1.5381; 1.5446; 1.5500

Sup: 1.5240; 1.5217; 1.5181; 1.5157

USDJPY

No significant changes seen in past 24-hour trading, as upside attempts through triangle top and daily Ichimoku cloud base, were short-lived and the price returned below psychological 120 support. Directionless mode is supported by mixed near-term technicals and neutral setup of daily SMA’s. Daily cloud top at 120.70 and 200SMA at 120.86, mark pivotal barriers and daily close above would generate bullish signal. On the downside, triangle support now lies at 119.64 and marks the first pivot. However, quick recovery after Friday’s dip to 118.67, suggests that strong buying interest exists and for now sidelines stronger downside attempts.

Res: 120.55; 120.70; 120.86; 121.30

Sup: 119.75; 119.64; 119.39; 119.05

AUDUSD

The pair remains well supported and cracks daily cloud base at 0.7207, on fresh extension of yesterday’s strong acceleration that marked the strongest daily gains since 08 Sep. Strong bulls are eyeing key barrier at 0.7278, 18 Sep peak, return to which to complete 0.7278/0.6935 pullback and signal recovery resumption, on break higher. Daily cloud base marks strong barrier and close above here, to confirm bulls for final attack at 0.7218 barrier.

However, overbought near-term studies, suggest consolidation. Potential corrective easing should be ideally contained by 4-hour Ichimoku cloud top at 0.7106, to keep near-term bulls intact.

Res: 0.7213; 0.7287; 0.7310; 0.7370

Sup: 0.7147; 0.7106; 0.7087; 0.7041

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.