EURUSD

The Euro fell back below 1.12 handle and pressures 200SMA, currently at 1.1156, following repeated upside rejection yesterday. The pair was unable to break above strong barrier at 1.1317, daily Ichimoku cloud top and bear-trendline, connecting 1.1712/1.1458 peaks. Yesterday’s rejection at 1.1288, where lower top was left, completed hourly failure swing on slide below 1.12 pivot, shifting near-term focus towards the lower boundary of near-term range, formed between 200SMA and daily cloud top. Near-term technicals are bearishly aligned, while neutral tone prevails on daily chart, as indicators are hovering around their midlines and setup of moving averages is mixed. However, long upper shadows of past two days candles, signals increased downside pressure. Violation of 200SMA, would trigger further weakness towards next strong support, daily 100SMA at 1.1138 and possibly open way towards key short-term breakpoints at 1.1105 / 1.1086. On the upside, lift above initial resistance at 1.1200, reinforced by daily 10SMA, opens of pivotal daily 20SMA at 1.1237.

Res: 1.1237; 1.1260; 1.1288; 1.1317

Sup: 1.1170; 1.1156; 1.1138; 1.1105

GBPUSD

Repeated recovery rejection at 1.5240 zone, signals limited upside action off near-term base at 1.5105 and suggests prolonged consolidation. Technicals of lower timeframes are negative and favor further weakness, after completion of consolidative phase, with scenario being supported by daily indicators, holding deep in the negative territory and firm bearish setup of daily MA’s which formed double Death-Cross of 20/200 and 30/200 SMA’s. Eventual break below 1.5105 base, to expose short-term targets at 1.5085, Fibonacci 61.8% of 1.4563/1.5928 and psychological 1.5000 support, in extension. Initial resistance lies at 1.5171, daily 10SMA, ahead of upside rejections at 1.5240 zone, also near-term consolidation ceiling. Key barrier lies at 1.5315, Death- Crosses and Fibonacci 38.2% of 1.5656/ 1.5105 downleg.

Res: 1.5171; 1.5200; 1.5240; 1.5287

Sup: 1.5135; 1.5105; 1.5085; 1.5050

USDJPY

The pair is regaining traction, after several days trading in narrow range, following yesterday’s break and marginal close above triangle resistance, currently at 120.27 and cracking thin daily Ichimoku cloud base at 120.50. Near-term technicals turned bullish on fresh attempts higher, however, daily structure is still in neutral/negative mode and requires sustained break above daily cloud top at 120.70 and 200 SMA at 120.86, to confirm bullish resumption. Otherwise, prolonged sideways trading is likely going to continue. Psychological 120 level marks initial support, ahead of yesterday’s low at 119.85, guarding downside pivot at 119.47, triangle support.

Res: 120.27; 120.55; 120.70; 120.86

Sup: 120.00; 119.85; 119.47; 119.24

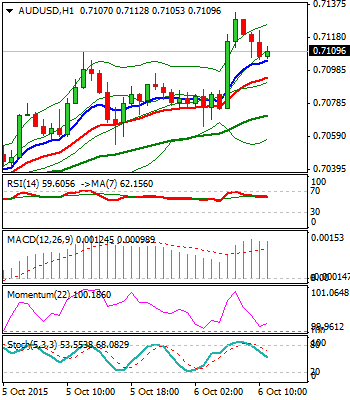

AUDUSD

Aussie resumes near-term recovery rally from 0.6935 base, with fresh attempts above 0.71 barrier, seen overnight, on unchanged RBA. Near-term studies remain bullish and look for further recovery, as fresh upside extension retraced nearly 61.8% of 0.7278/0.6935 downleg. Look for rallies towards falling daily 55SMA at 0.7182, where recovery may pause, as daily slow Stochastic is entering overbought territory and would signal pullback on reversal. The action is so far contained by 4-hour Ichimoku cloud top at 0.7106, guarding daily 20SMA at 0.7074, loss of which to signal stronger pullback.

Res: 0.7132; 0.7147; 0.7182; 0.7206

Sup: 0.7106; 0.7074; 0.7033; 0.7010

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.