EURUSD

The Euro fell back near 1.12 support, on yesterday’s repeated failure to break above 200SMA and sustain gains above 1.13 barrier. The day closed in long red candle that gives bearish signal, with overnight’s trading being shaped in tight Doji and touched strong support at 1.1205, daily 20SMA. Near-term studies are weak and see risk of violation of 20SMA support, to expose key near-term supports at 1.1154, 28 Aug low and 1.1121, daily Ichimoku cloud top, triggers for fresh weakness. Quiet trading is seen likely, ahead of today’s ECB meeting, with initial Sup/Res levels at 1.1205, 20SMA and 1.1284, 200SMA. Daily studies remain bullish and favor fresh upside attempts, while rising daily 20SMA holds.

Res: 1.1278; 1.1284; 1.1318; 1.1331

Sup: 1.1203; 1.1166; 1.1154; 1.1121

GBPUSD

Cable continues to move lower, after taking out key 1.5327 support, with close below psychological 1.53 support, confirming bearish stance. Yesterday’s long-legged Doji, signals hesitation on approach to next support at 1.5246, 50% retracement of 1.4563/1.5928, Apr/June rally, however, overall bearish structure keeps focus at the downside and break lower to expose next targets at 1.5189/68, lows of 05/01 June. Initial resistance lies at 1.5324, yesterday’s high, with 200SMA at 1.5359, expected to ideally cap. Alternative scenario would be triggered on daily close above 200SMA, to signal stronger correction.

Res: 1.5311; 1.5324; 1.5359; 1.5393

Sup: 1.5265; 1.5246; 1.5189; 1.5168

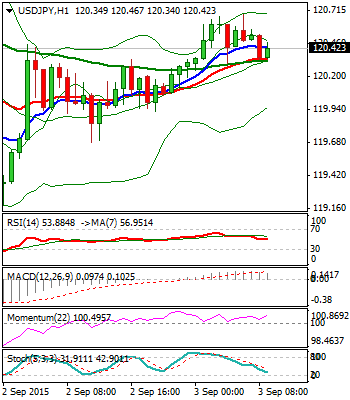

USDJPY

The pair met its initial target, at 120.70, session high and daily Kijun-sen line, also 50% retracement of 125.26/116.13 downleg and came ticks away from of key 200SMA. Fresh rally extended recovery that left higher low at 119.20 zone and ended yesterday’s trading in long bullish candle that gives positive signal, amid generally bearish tone. However, improving near-term studies see room for further upside, with sustained break above 200SMA trigger, being required. Such scenario would open next breakpoint at 121.64, recovery peak of 31 Aug. Otherwise, downside risk would intensify, while the price remains capped by 200SMA.

Res: 120.75; 121.25; 121.64; 122.01

Sup: 120.19; 119.68; 119.52; 119.18

AUDUSD

Aussie trades in near-term consolidative phase, above fresh low at 0.6980, posted yesterday, on a probe below former target, at psychological 0.7000 level. Yesterday’s positive close gives signal of hesitation for clear break below 0.7000 handle, as daily studies are oversold, but no reversal signal being generated yet. Look for extended consolidation under initial barrier at 0.7122, falling daily 10SMA. Break here, to give initial bullish signal and expose next barriers at 0.7204, lower top of 28 Aug and 0.7242, falling daily 20SMA and trigger for stronger corrective rallies. Otherwise, repeated attempts below 0.7000 and sustained break lower, to signal resumption of larger downtrend.

Res: 0.7060; 0.7122; 0.7204; 0.7242

Sup: 0.7000; 0.6980; 0.6933; 0.6870

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.