EURUSD

The Euro trades in a tight range, entrenched within daily 100SMA and daily cloud that marks initial range. The lower boundary was cracked but no clear break seen so far, to confirm downside resumption and open next support at 1.0992, daily cloud base. However, near-term structure remains negative and sees further weakness favored. Bearish resumption through initial 100SMA and cloud base, to face week’s low at 1.0952, with short-term support at 1.0818, low of 27 May, expected to come in focus on further acceleration lower. Conversely, daily close above Ichimoku cloud top, would ease immediate downside risk, while return above falling daily 10SMA at 1.1167, would provide relief and focus daily 20SMA breakpoint at 1.1232. Lower volumes are expected due to US holiday, with uncertainty ahead of Sunday’s Greek referendum, requiring caution.

Res: 1.1140; 1.1167; 1.1193; 1.1232

Sup: 1.1039; 1.1016, 1.0992; 1.0952

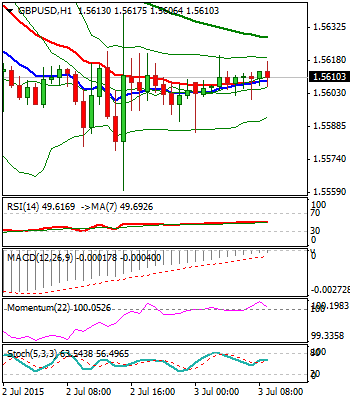

GBPUSD

Cable ended yesterday’s trading in long-legged Doji, signaling hesitation on approach to 1.5548, 50% of 1.5168/1.5928 rally / daily Kijun-sen line, as yesterday’s dip was contained at 1.5560. This confirms 1.5548/60 as strong near-term support zone. Prolonged consolidation is expected, as near-term studies are in neutral/negative mode, while daily studies hold bullish tone but conflicting daily MA’s suggest no clear direction. Loss of 1.5548 handle would soften near-term tone for further correction and expose next strong support zone and breakpoints at 1.5454, daily 55/200SMA’s Golden cross and daily Ichimoku cloud top at 1.5442. Daily 20SMA caps at 1.5657, with daily close above, required to sideline downside risk.

Res: 1.5638; 1.5657; 1.5700; 1.5729

Sup: 1.5586; 1.5560; 1.5548; 1.5500

USDJPY

The pair consolidates around 123 handle, following yesterday’s recovery rejection at 123.70 and pullback, triggered by disappointing US jobs data. The move is for now seen as corrective action, with 123 support zone required to hold, for fresh attempts higher. Near-term technicals are in neutral mode, while daily studies are mixed and contracting 20d Bollingers, suggest extended consolidation. As yesterday’s probe above descending daily 20SMA, was seen as false break, this now marks initial barrier at 123.33, with close above, required to signal fresh rallies. Extension above yesterday’s high at 123.70 to confirm and expose pivotal 124.36/42 tops. Otherwise, expect further easing and renewed pressure at pivotal 122 support, on sustained break of 123 handle.

Res: 123.33; 123.70; 124.00; 124.36

Sup: 122.79; 122.34; 122.00; 121.82

AUDUSD

The pair remains under pressure, with overnight’s fresh acceleration lower from session’s high at0.7647, eventually cracking former week’s low at 0.7584, posted after Monday’s gap-lower open. Firm bearish tone is seen on all timeframes and sees scope for final push towards key 0.7531 support, 02 Apr low, to confirm completion of 0.7531/0.8161 corrective phase and signal resumption of broader downtrend. Session peak at 0.7647, offers initial resistance, ahead of falling daily 10SMA at 0.7677 and pivotal daily 20SMA at 0.7710. Only close above here would sideline near-term bears.

Res: 0.7647; 0.7677; 0.7710; 0.7740

Sup: 0.7565; 0.7531; 0.7500; 0.7450

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.