The Euro returned to weakness after fresh acceleration lower ended near-term consolidative phase between 1.3150 and 1.3220 limits. Fresh attempts lower target immediate support at 1.31, psychological support and low of September 2013, below which opens double-Fibonacci support at 1.3020 zone, 50% retracement of 1.2042/1.3992 ascend and 138.2% expansion of the wave from 1.3699. Near-term bears continue to favor further downside, with corrective rallies on oversold conditions, expected to interrupt and to be ideally capped under 1.32 barrier. Overextended daily studies, however, warn of more significant corrective action, which requires sustained break above near-term congestion tops at 1.3220 to be confirmed.

Res: 1.3133; 1.3150; 1.3194; 1.3220

Sup: 1.3117; 1.3103; 1.3050; 1.3020

GBPUSD

Cable near-term studies are regaining traction, as bounce off 1.6534 low attempts to sustain break above 1.66 barrier. Fresh bulls above 1.6610, where descending 4-hour 55SMA was capping the upside attempts until now, confirm basing attempt and bring bulls fully in play for push towards pivotal 1.6677/87, 20 Aug lower top / 20/200SMA death cross and possible extension to the key near-term barrier at 1.6735 lower platform. However, overall negative tone sees current movements as corrective action and failure to clear 1.6735 barrier, would keep in play scenario of lower top formation and subsequent fresh weakness.

Res: 1.6651; 1.6677; 1.6685; 1.6735

Sup: 1.6585; 1.6560; 1.6534; 1.6500

USDJPY

The pair remains in near-term corrective phase, off fresh high at 104.26, posted on 25 Aug, after fresh bulls cracked key 104.11, 04 Apr peak, the last obstacle en-route to 105.43, 02 Jan peak. Corrective easing found support at 103.50, 22 Aug low, ahead of fresh attempt through 104 barrier. This keeps near-term bulls in play for eventual push through 104.26, 25 Aug fresh high, to resume larger bulls towards psychological 105 barrier and key resistance at 105.43, 02 Jan peak. Today’s gap-higher open, confirms bullish stance, with corrective easing, expected to be ideally contained at 104.00/103.80 zone.

Res: 104.20; 104.26; 104.50; 105.00

Sup: 104.00; 103.80; 103.50; 103.20

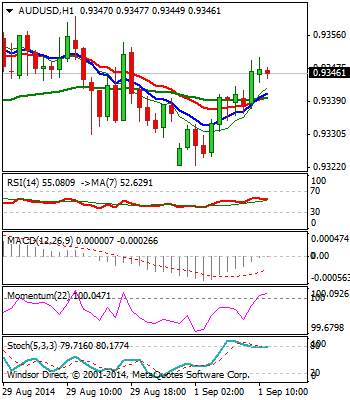

AUDUSD

Near-term bulls remain in play, as the pair tested pivotal 0.9372 barrier, lower top of 06 Aug and 50% of 0.9503/0.9237 descend. Consolidative phase so far found support at 0.9320, Fibonacci 38.2% of 0.9237/0.9372, keeping immediate focus at the upside. Break above 0.9372 is required to confirm base at 0.9237 for more significant correction of 0.9503/0.9237 descend, with 0.94 psychological barrier / 61.8% retracement and 0.9415 lower top, seen as immediate targets. Otherwise, prolonged sideways trade could be expected in the near-term, in case of failure to break 0.9372 barrier, with bearish tone to be established in case of loss of 0.93 support.

Res: 0.9361; 0.9372; 0.9400; 0.9440

Sup: 0.9320; 0.9300; 0.9288; 0.9268

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.