The Euro came under increased pressure, with yesterday’s acceleration lower, erasing most of gains from 1.2603 low to 1.2765, where rally stalled, short of key 1.2790 peak. Negative tone has established on hourly studies and keeps focus at the floor of larger range at 1.2603. With 4-hour indicators turning lower, immediate risk is seen on a break below 1.26 handle, also near Fibonacci 61.8% retracement of 1.2499/1.2790 upleg, which would confirm failure swing formation and look for further retracement of 1.2499/1.2790 corrective rally. Yesterday’s close in red and below daily 20SMA, supports near-term negative stance, which requires clear break below 1.2603 support, to confirm an end of near-term directionless mode and bring bears fully in play. Strong support lies at 1.2603, loss of which to open 1.2567, low of 30 Sep and Fibonacci 76.4% retracement of 1.2499/1.2790 rally, the last significant obstacle towards key near-term support at 1.2599, 03 Oct low.

Res: 1.2678; 1.2700; 1.2730; 1.2766

Sup: 1.2610; 1.2603; 1.2567; 1.2499

GBPUSD

Cable maintains negative tone and probes below psychological 1.59 support, where the downmove met its 100% Fibonacci expansion of the third wave from 1.6125 lower top. Yesterday’s close in long red candle and completion of 1.5950/1.6225 corrective rally, confirms bears are fully in play for further extension of the downtrend from 1.7189, 13 July peak. Sustained break below 1.59 handle to open 1.5853, Nov 2013 low, with the wave capable of traveling to 1.5823, its 138.2% Fibonacci expansion and double Fibonacci support at 1.5720, 161.8% expansion and 61.8% retracement of larger uptrend from 1.4812 to 1.7189. Previous lows at 1.5950 and 1.6000, offer initial resistances, with stronger rallies expected to be capped under 1.61 barrier, Fibonacci 61.8% of 1.6225/1.5875 downleg.

Res: 1.5950; 1.6000; 1.6050; 1.6100

Sup: 1.5875; 1.5853; 1.5823; 1.5800

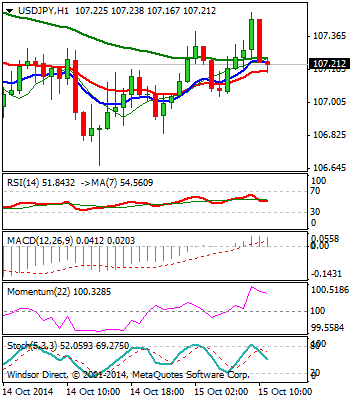

USDJPY

The pair consolidates above fresh and marginally lower low at 106.65, posted yesterday, where descend met its 38.2% retracement of larger 101.07/110.07 ascend. Consolidative action is under way and faces the first resistance at 107.50 zone, while break above the significant barrier at 108 zone, also near Fibonacci 61.8% of 108.73/106.65 downleg, would sideline bears and signal basing attempt. Hourly studies turned positive, while yesterday’s positive close turned daily indicators towards the upside, which supports near-term action higher, with clearance of initial 107.50 barrier, required to signal stronger recovery and open 108.00/15 breakpoint zone.

Res: 107.56; 107.94; 108.15; 108.31

Sup: 107.00; 106.83; 106.65; 106.00

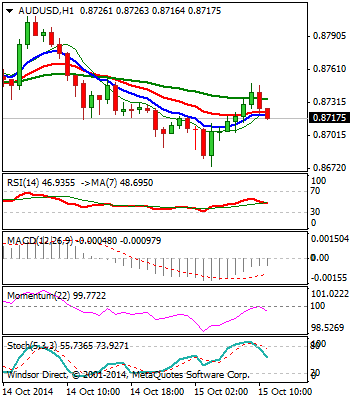

AUDUSD

The pair remains in directionless mode, with near-term price action being entrenched within 0.8641/0.8896 range. The tone of near-term studies is neutral and requires break of either side to establish fresh direction. On the other side, overall bearish trend sees current consolidation preceding fresh leg lower, as a part of larger downtrend from 2011 peak at 1.1079. Yesterday’s failure to sustain break above psychological 0.88 barrier, also Fibonacci 61.8% of 0.8896/0.8650 downleg, keeps the price action in the lower part of the range.

Res: 0.8785; 0.8812; 0.8832; 0.8896

Sup: 0.8700; 0.8673; 0.8650; 0.8641

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'