The Euro continues to trade in a sideways mode, capped for now under 1.2977/85 barriers, with corrective pullbacks being contained above 1.29, round-figure support / Fibonacci 61.8% of 1.2858/1.2977 corrective rally. Neutral near-term studies see scope for further consolidation, while overall negative tone, renewed with yesterday’s close in red, suggests fresh leg lower after completion of near-term consolidative phase. Strong barriers at 1.2977/85, as well as psychological 1.3000 resistance, keep the upside limited for now and only break above the latter would revive near-term bears for stronger bounce, which would sideline attempts towards short-term targets at 1.2786, Fibonacci 61.8% of 1.2042/1.3992 and 1.2750 higher base.

Res: 1.2958; 1.2977; 1.2987; 1.3000

Sup: 1.2920; 1.2900; 1.2882; 1.2858

GBPUSD

Cable’s near-term price action remains in consolidative mode, with immediate tone showing signs of weakness, as the price action moves towards the consolidation floor at 1.62 zone, after yesterday’s close in red. Recovery peak at 1.6275, has so far limited the upside action, keeping psychological 1.63 barrier and previous week’s closing level and the upper limit of 08 Sep opening gap, intact. Near-term studies are neutral and unless 1.63 hurdle is taken out, which would allow for stronger recovery and confirm near-term bottom, risk will remain at the downside, as overall picture remains negative.

Res: 1.6249; 1.6275; 1.6300; 1.6338

Sup: 1.6200; 1.6184; 1.6155; 1.6123

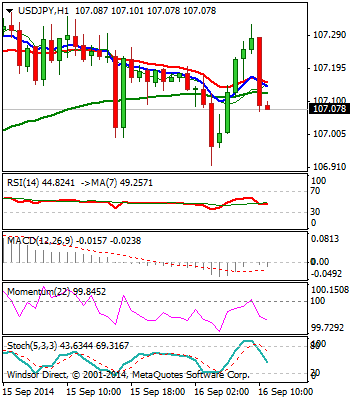

USDJPY

The pair remains positive overall, with near-term price action moving in consolidative mode, which was signaled by yesterday’s Doji candle. Important 107 support holds for now, despite brief probe below overnight, keeping immediate focus at the upside, for test of initial target at 107.50, ahead of 108.28, Fibonacci 161.8% projection of the upleg from 100.81. Extended dips, however, should be contained at 106.50/35 zone, to keep bulls unharmed.

Res: 107.38; 107.50; 108.00; 108.28

Sup: 106.92; 106.50; 106.35; 106.00

AUDUSD

The pair maintains negative tone, with near-term corrective action off fresh low at 0.8982, being capped at 0.9050, by descending hourly 55SMA. Fresh weakness below 0.90 handle, confirms bears are in play, for fresh extension towards the next target at 0.8889, 02 Mar higher low, with full retracement of 0.8658/0.9503 ascend, being in play. Only fresh strength above 0.9050 would sideline immediate bears for stronger corrective attempt.

Res: 0.9000; 0.9020; 0.9050; 0.9071

Sup: 0.8980; 0.8950; 0.8923; 0.8900

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.