The Euro is near-term corrective mode after fresh bears broke below 1.2930, 1.2660/ 1.2754 bull-trendline and extended under 1.29 handle, to reach fresh low at 1.2858. Recovery action was supported by yesterday’s positive close, however, no significant upside action would be expected, as long as 1.2987, yesterday’s high and psychological 1.30 barrier stay intact. Hourly studies gained traction, while 4-hour structure remains weak, along with overall negative picture, which keeps focus at 1.2786, Fibonacci 61.8% retracement of 2012/2014 1.2042/1.3992 ascend and 1.2750 zone, Mar/July 2013 lows, higher platform.

Res: 1.2977; 1.2987; 1.3000; 1.3044

Sup: 1.2858; 1.2800; 1.2786; 1.2750

GBPUSD

Cable consolidates recent losses and shows near-term basing attempt at fresh lows, just ahead of psychological 1.6000 support. Upside heading near-term indicators are supportive for stronger corrective action, which was signaled by oversold daily conditions and yesterday’s Doji candle. Confirmation of such scenario requires today’s positive close. Initial resistance lies at 1.6185, 08 Sep intraday high, ahead of more significant 1.6230, week’s high, clearance of which to accelerate attempts of Monday’s gap filling and regain of pivotal 1.6330 lower top. Otherwise, narrow consolidation would be expected to precede eventual attack at 1.60 support.

Res: 1.6185; 1.6230; 1.6280; 1.6300

Sup: 1.6057; 1.6000; 1.5967; 1.5900

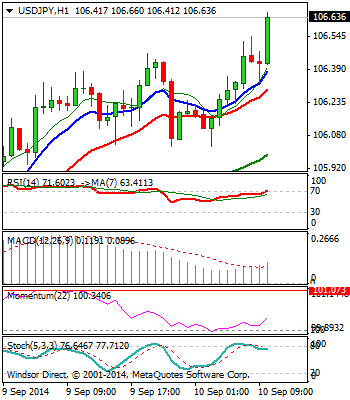

USDJPY

The pair remains well supported and continues to trend higher, with near-term price action establishing above 106 handle. Fresh gains post new 4-year highs, with upside targets at 107.20, Fibonacci 138.2% projection of the upleg from 100.81 and 108.28, Fibonacci 161.8% projection. Further gains are expected to open Sep 2008 high at 109.10, and lower top at 110.66, posted in Aug 2008. Initial supports lay at 106.00 and 105.70, where dips should ideally find footstep. Otherwise deeper pullback is expected to threaten 105.40, Fibonacci 61.8% of 104.67/106.55 and psychological 105 support, in extension.

Res: 105.70; 106.00; 106.20; 106.50

Sup: 106.00; 105.70; 105.00; 104.70

AUDUSD

Near-term structure remains bearish, with increased pressure eventually pushing the price through near-term bases at 0.9237 and 0.9200, as well as 0.9180, Fibonacci 38.2% retracement of 0.8658/ 0.9503 ascend/200SMA. This confirms an end of short-term congestion and further reversal off 0.9503 peak. The price is now looking for extension towards 0.9100, round-figure support and 0.9080, 50% retracement, ahead of 0.9050, weekly Ichimoku cloud base. Overall bearish structure supports the notion, with corrective attempts to face 200SMa as initial resistance, ahead of former bases at 0.92 and 0.9237.

Res: 0.9180; 0.9200; 0.9217; 0.9237

Sup: 0.9100; 0.9080; 0.9050; 0.9000

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.