The pair fell sharply to 145.57 last Friday, leaving near-term top at 149.12. Friday’s close in red, justifies last Thursday’s Shooting Star, along with weekly Doji with long upper shadow, signaling hesitation ahead of psychological 150 barrier. Dips were contained for now at Fibonacci 23.6% of 134.12/149.12 rally, reinforced by 4-hour 55EMA and more significant daily 10SMA. Break and close below here to confirm negative stance for further easing towards 143.40, Fibonacci 38.2% retracement. Corrective bounce off 145.57, approaches important 147 resistance zone, Fibonacci 38.2% of 149.12/145.57 downleg, reinforced by 4-hour Tenkan-sen/Kijun-Sen bear cross, where rally should be ideally capped. Otherwise break and close above here, would sideline downside risk, with fresh extension above 147.75/148, Fibonacci 61.8% / Friday’s intraday highs, to signal higher low formation and shift focus towards 149.12 peak.

Res: 147.00; 147.35; 147.75; 148.00

Sup: 146.65; 146.37; 146.00; 145.57

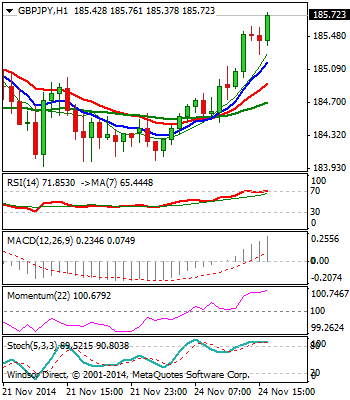

GBPJPY

Near-term tone turned positive after the pair fully reversed last Friday’s 185.67/183.95 descend, on a bounce from hourly higher base at 183.95, also broken 50% of larger 251.08/116.82 descend. The pair is looking for completion of 186.09/183.95 consolidation, before resuming higher. Overall bullish picture favors further upside, as rally retraced over 50% of multi-year fall from 251.08. Sustained break above 186 barrier, to open Fibonacci projection level at 186.80 and look for psychological 190 barrier, in extension. However, prolonged consolidative phase could be triggered by overextended daily studies. Initial support at 183.95, along with daily Tenkan-sen line at 183.60, should ideally hold, guarding more significant 181 higher base. Only break here would signal stronger pullback.

Res: 185.80; 186.09; 186.80; 187.00

Sup: 185.27; 185.00; 184.47; 184.00

EURGBP

The pair remains under pressure in the near term, as last Friday’s acceleration lower, tested 0.79 support today, near Fibonacci 61.8% of 0.7800/0.8037 rally. On the other side, larger picture studies are positive, but bulls are coming under pressure after last Friday’s and weekly close in red. Today’s close below daily 10SMA at 0.7943, would keep the downside vulnerable, with violation of psychological 0.79 support and daily 20/55SMA’s bull cross at 0.7892, required to confirm further range-trading and expose 0.8045/0.7797 rage’s lower levels, for test.

Res: 0.7933; 0.7953; 0.7985; 0.8000

Sup: 0.7890; 0.7860; 0.7800; 0.7765

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.