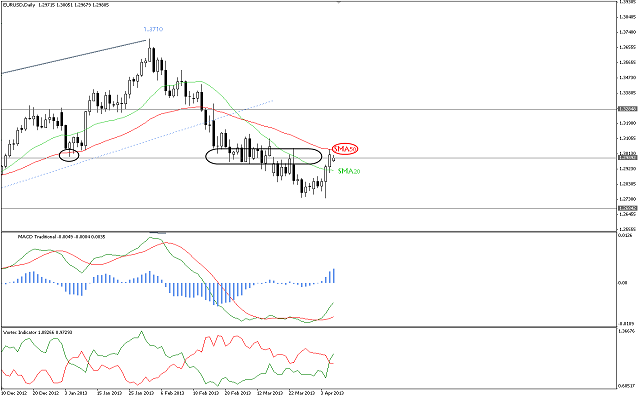

The pair has showed a strong rebound from 1.2750 zones and is currently hovering around very sensitive areas below SMA 50-valued at 1.3040- as seen on the provided daily chart. The positivity on technical indicators suggests further appreciation but we will not be bullish unless prices take out 1.3040.

The trading range for this week is among the key support at 1.2750 and key resistance at 1.3275.

The general trend over short term basis is to the downside targeting 1.2560 as far as areas of 1.3270 remains intact.

Support 1.2945 1.2905 1.2865 1.2800 1.2750

Resistance 1.3040 1.3085 1.3110 1.3140 1.3170

Recommendation Based on the charts and explanations above, our opinion is buying the pair above 1.3040 targeting 1.3245 and stop-loss with four-hour closing below 1.2905 might be appropriate this week

GBP/USD

Cable has managed to breach the initial resistance level of 1.5260-turned into support- to confirm the rebound from 1.5020 zones as seen on the provided daily chart. The current upside recovery may continue supported by stability above SMA 20 and SMA 50 mainly targeting 1.5500 levels but 1.5180 should hold to keep the positivity on technical indicators unchanged.

The trading range for this week is among key support at 1.5130 and key resistance at 1.5555.

The general trend over short term basis is to the downside targeting 1.4225 as far as areas of 1.6875 remains intact.

Support 1.5300 1.5260 1.5180 1.5130 1.5020

Resistance 1.5370 1.5445 1.5500 1.5555 1.5625

Recommendation Based on the charts and explanations above, our opinion is buying the pair above 1.5295 targeting 1.5500 and stop-loss with four-hour closing below 1.5180 might be appropriate

USD/JPY

The violent upside actions seen during the previous week continued with the opening of this week and the pair has started the week with a gap while RSI 14 reflects extreme overbought case. Henceforth, we should stand aside today to see whether the gap will be covered over upcoming sessions or not. Of note, a break above 99.00 will weaken the psychological level of 100.00 and will expose 101.50 territories.

The trading range for this week is among key support at 95.50 and key resistance at 101.50.

The general trend over short term basis is to the upside targeting 100.00 as far as areas of 84.00 remain intact.

Support 98.30 97.60 97.00 96.70 95.50

Resistance 99.00 99.50 100.00 100.60 101.50

Recommendation Based on the charts and explanations above, our opinion is stayind aside until an actionable setup presents itself to pinpoint the next move.

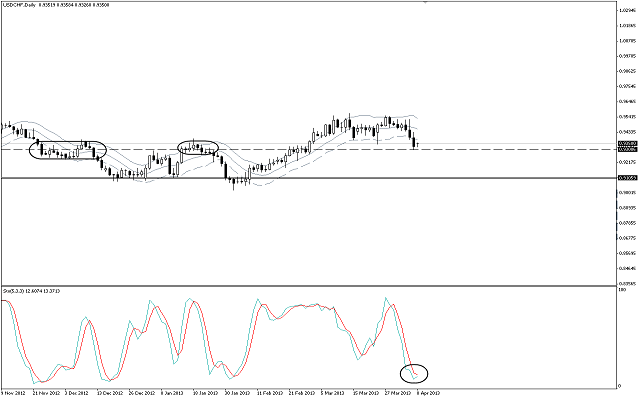

USD/CHF

The pair is currently hovering around very sensitive support zones- previous resistance- as seen on the provided daily chart. Stochastic shows a probability of drawing a positive overlap, while moving below the lower line of Keltner channel is seen as overbought sign. Hence, we should stand aside until the pair affirms the bearish pressures seen during the last week.

The trading range for this week is among key support at 0.9070 and key resistance at 0.9600.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

Support 0.9300 0.9245 0.9180 0.9125 0.9070

Resistance 0.9400 0.9465 0.9500 0.9530 0.9600

Recommendation Based on the charts and explanations above, our opinion is staying aside until an actionable setup presents itself to pinpoint the next move.

USD/CAD

The pair tried to breach 1.0200 but stabled below it keeping our bearish expectations valid till now, as we anticipate reaching the targets starting at 1.0120 then 1.0075. The downside effect of the harmonic pattern shown on graph is valid, as breaking 1.0140 levels will ease achieving the awaited targets.

The trading range for this week is among the key support at 1.0000 and key resistance at 1.0355.

The general trend over short term basis is to the upside with steady daily closing above 0.9800

targeting 1.0485

Support 1.0165 1.0120 1.0075 1.0055 1.0005

Resistance 1.0200 1.0290 1.0310 1.0355 1.0420

Recommendation Based on the charts and explanations above, our opinion is selling the pair below 1.0200 targeting 1.0140, 1.0100 then 1.0015 and stop-loss with four-hour closing above 1.0290 might be appropriate this week

AUD/USD

AUD/USD has broken pivotal levels between 1.0415 and 1.0385 and resided below them, activating the downside effect over the intraday basis. We now expect bearish objectives reaching 1.0230. The pair finds solid support at 1.0360; it is required to break that level to bolster our bearish expectations, which stand intact, unless if the pair breaches and holds ground above 1.0415.

* Trading range expected this week is between the key support at 1.0150 and the key resistance1.0560.

* Short-term trend is downside targeting 0.9400 if 1.0710 remains intact.

Support 1.0355 1.0300 1.0270 1.0225 1.0200

Resistance 1.0410 1.0440 1.0465 1.0500 1.0560

Recommendation Based on the above graph and analysis, we recommend selling the pair below 1.0365 targeting 1.0300, 1.0230 and 1.0150 and stop-loss by four-hour closing above 1.0410 this week.

NZD/USD

NZD/USD flip-flops around Linear Regression Indicators, received with a minor positivity from Stochastic, whereas the expected bearish direction is still standing. The main condition is that the pair settles below 0.8450 with objectives primarily kicking off at 0.8275. Note that breaking 0.8500 will confirm the pair's return into the ascending channel that was broken earlier.

* Trading range expected this week is between the key support at 0.8165 and the key resistance0.8620.

* Short-term trend is downside targeting 0.8845 if 0.8130 remains intact.

Support 0.8355 0.8310 0.8275 0.8225 0.8200

Resistance 0.8450 0.8480 0.8500 0.8535 0.8575

Recommendation Based on the above graph and analysis, we recommend selling the pair below 0.8400 targeting 0.8310 and 0.8225 and stop-loss by four-hour closing above 0.8500 this week.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0600 as focus shifts to Powell speech

EUR/USD fluctuates in a narrow range above 1.0600 on Tuesday as the better-than-expected Economic Sentiment data from Germany helps the Euro hold its ground. Fed Chairman Powell will speak on the policy outlook later in the day.

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

Gold price remains depressed near $2,370 amid bullish USD, lacks follow-through selling

Gold price (XAU/USD) attracts some sellers during the early part of the European session on Tuesday and reverses a major part of the overnight recovery gains from the $2,325-2,324 area, or a multi-day low.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

Canada CPI Preview: Inflation expected to accelerate in March, snapping two-month downtrend

The Canadian Consumer Price Index is seen gathering some upside traction in March. The BoC deems risks to the inflation outlook to be balanced. The Canadian Dollar navigates five-month lows against the US Dollar.