Following the tumultuous start to the year, the first quarter saw the equity markets managing to recover from the initial bout of strong losses. The central bank decisions in the first quarter had something to do with it as the Federal Reserve switched sides to come out strongly dovish following the start of a rate hike cycle in 2015 December. The soft talk managed to help push the equities, which were hit by tighter monetary policy conditions and a global slowdown in the markets. By March end, a broad turnaround in the manufacturing sectors increased hopes of a recovery taking place. US ISM manufacturing PMI managed to expand, rising above the 50-level in the index for the first time in November/December of 2015, while China's manufacturing PMI also managed to make some gains following a bad start to the year.

Another major theme from the first quarter which was weighing on investors’ minds was the rather subtle approach by global central banks. The US dollar was subtly talked down, while Mario Draghi seemed unconcerned on the euro's rally post the March ECB meeting which saw strong policy decisions being made. This led many to believe that central bankers might have struck a deal at the earlier G20 summit not to indulge in currency wars.

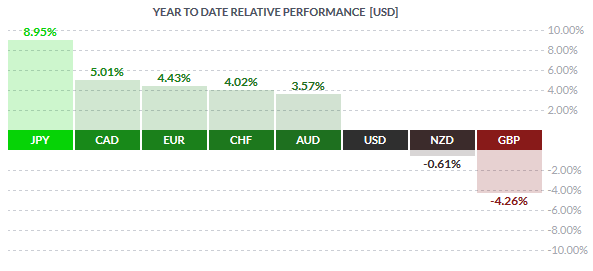

There was some kind of hope as most of the commodity linked currencies posted strong gains including the Canadian dollar and the euro while the British Pound was the exception to the case.

As the second quarter began however, the markets are starting to see a bit of the currency wars coming back. More recently, April's RBA statement brought back the reference to exchange rates. In the statement, the RBA said "The Australian dollar has appreciated somewhat recently. In part, this reflects some increase in commodity prices, but monetary developments elsewhere in the world have also played a role. Under present circumstances, an appreciating exchange rate could complicate the adjustment under way in the economy."

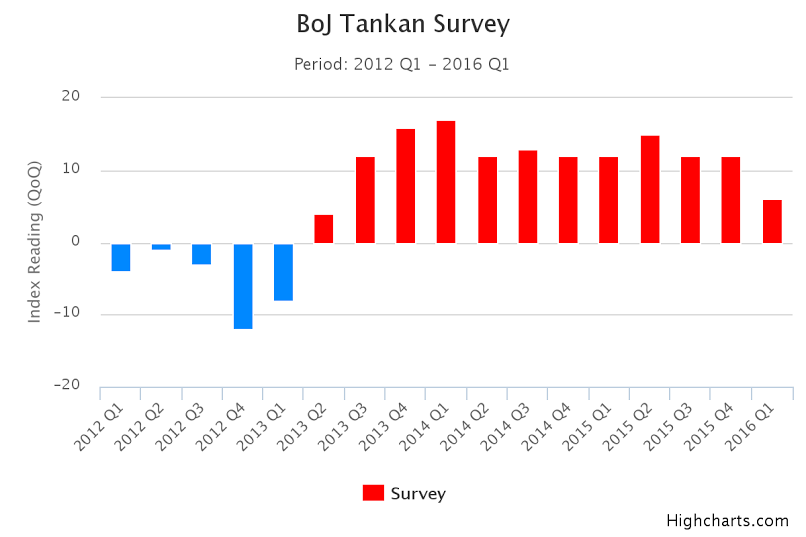

Meanwhile, officials in Japan are clearly worried on the appreciation of the yen which has made strong progress into the year. Although refraining from directly talking down the currency, Japanese officials sent a stern warning to speculators in reference to the yen’s exchange rate which has been clearing hitting business sentiment in an export oriented economy. This was followed by Japanese Premier, Shinzo Abe stating that central banks should refrain from actively devaluating their currencies, in a veiled attempt but clearly pointing to the Federal Reserve. This comes in light of Janet Yellen’s recent dovish remarks on US rate hikes which sent the dollar weaker across the board.

It could be only a matter of time before more such talk comes out in the open. Recently, Canadian trade deficit data showed a widening in the deficit as exports fell in the month of February as investors were concerned that following a strong 0.60% monthly GDP growth in January, the Canadian economy could start to flip over again. While previous gains came upon a weaker exchange rate of the CAD, it is quite evident that the recent appreciation is starting to take a toll on the economy already. On a year to date basis, the Canadian dollar has gained over 5.0% to the US dollar and a continued appreciation in the exchange rate could mean further weakness unless Oil prices start to post a strong rebound.

In conclusion, it is too early to tell whether central bankers have indeed agreed not to talk down their currencies but there is growing evidence that regardless of whether a deal was struck or not, export and commodity oriented economies are likely to feel the heat of a weaker dollar. Perhaps, currency wars will indeed make a comeback sometime this year.

AllFXBrokers does not bear any responsibility for losses incurred from depositing with brokers we list or advertise. If in doubt please seek independent investment advice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.