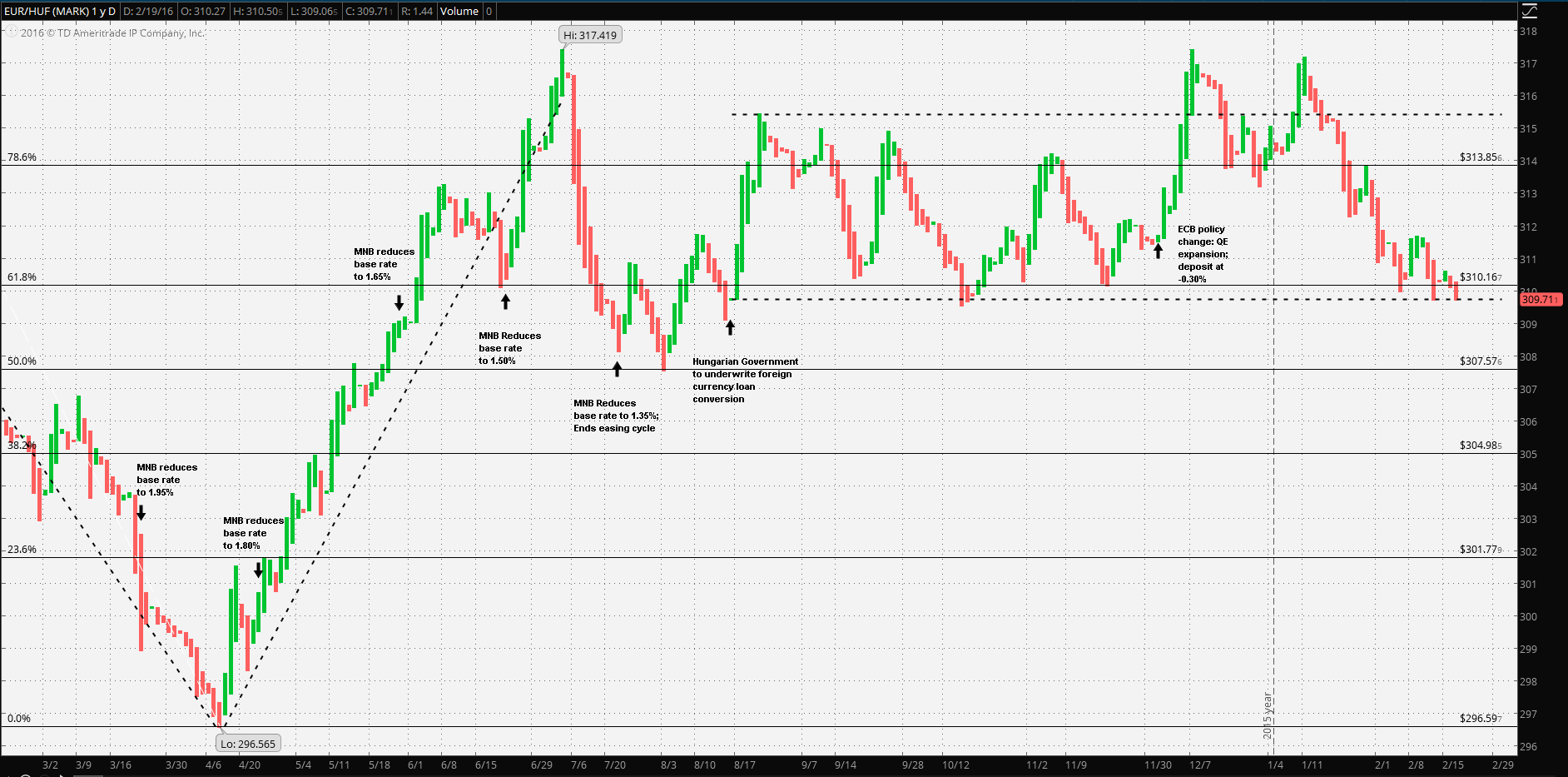

However, the most striking feature demonstrated in the chart is the relative stability of the Euro-Forint exchange after the foreign mortgage debate was resolved: not more than a 1% variation from the simple average from 18 August; well within an acceptable range of the official exchange rate of 309.85. It remained so until the 3 December ECB 10 basis point reduction of the overnight deposit rate to negative 0.30%.

It’s worth noting a few key comments in the intervening period from the last rate reduction in July until the 3 December ECB meeting. For instance, at the August meeting the MNB like other EU members had expected inflation to gradually increase going forward: “...Core inflation is likely to rise gradually as domestic demand picks up; however, the continuing decline in commodity prices may moderate the increase in the consumer price index...” The MNB also expressed its concerns over China and over the future rate decisions of the Fed: “...global risk appetite deteriorated, reflecting uncertainty about Chinese capital market... ... as well as an impending interest rate increase by the US Fed...” There was no mention of the ECB.

Inflation, or the lack thereof, continued to be an ongoing concern of the MNB as noted in the 20 October statement but still expressed optimism: “...Consumer prices fell in September 2015. Core inflation was broadly unchanged... ...Inflation is expected to move to positive territory in the coming months... ... and is only likely to rise to levels around 3 per cent at the end of the forecast horizon...” The MNB gently expressed its disagreement with the Fed’s expected rate increase: “... concerns over growth prospects in emerging economies had a negative impact on global appetite for risk. Global financial market environment improved in the second half of the period as market expectations of the Fed’s interest rate increase were postponed...”

At the 17 November meeting the ECB came into play: “... the ECB’s communication suggesting that it would adopt a looser monetary policy stance looking forward... ...Conditions in Hungarian financial markets were characterised by increased volatility, with the forint depreciating slightly against the euro...”

The next meeting, 15 December was held well after the ECB meeting of 3 December and coincided with the Fed’s 15-16 December meeting. The after-the-fact wording was unchanged from the previous statement: “...the main factors affecting appetite for risk were the ECB’s communication suggesting that it would adopt a looser monetary policy stance...” Surprisingly, EUR/HUF weakened, breaking out of its channel shortly after the ECB announcement 3 December.

The most recent meeting 26 January the MNB noted a continued gradual increase in core inflation as well as concerns over the lack of domestic economic growth. The main concern, however shifted from the ECB and Fed to China: “...risk indicators rose significantly... ... in response to unfavourable macroeconomic data from China, the fall in the Chinese equity market and the significant drop in oil prices...”

The most important point was the bank’s expressed satisfaction with “...unconventional, targeted monetary policy instruments... ... facilitate a decline in long-term yields... ... consequently... ... loosening in monetary conditions. Forward-looking money market real interest rates are in negative territory...”

As far as the base rate, the bank was specific: “...the current level of the base rate and maintaining loose monetary conditions for an extended period... ... are consistent with the medium-term achievement of the inflation target ...”

It all leads to the key point in the concluding paragraph: “...the Council closely examines developments in the foreign monetary environment, particularly the measures of the European Central Bank...”

All other issues aside, the Magyar Nemzeti Bank has a good hand at the helm. The MNB has carefully offset the exogenous deflationary effects with an expansionary policy which keeps the Forint at levels which support its export economy with its most significant trade partners in the EU and particularly in the Eurozone.

It’s reasonable to expect the MNB to maintain its three month MNB deposit facility as well as maintaining the Forint at 309 support to 317 resistance. Further, it’s reasonable to expect the MNB to do so, should the ECB continue easing.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.