It’s important to note here that the ‘non-Eurozone’ EU members who have or plan to reestablished border controls, (including Schengen area members), are former Warsaw Pact members: Hungary, Bulgaria, Romania and Serbia . Poland hasn’t been as affected, but it is sympathetic with its fellow former ‘bloc’ nations as evidenced in the recent sweeping election victory of the conservative opposition. Of those CEE-EU members, only Slovakia and Slovenia are Eurozone members. It should also be noted that civil war torn Ukraine shares borders with Poland, Slovakia, Hungary and Romania in a Europe where Russia is increasingly and aggressively asserting itself in the region.

It raises the question whether CEE EU members ‘perceive’ themselves as integral parts of a unified Europe or the eastern part of divided Europe.

At the very epicenter of the European Union migration dispute is EU member nation, Hungary and its Prime Minister Viktor Orban. The 6 April, 2014 elections has swept the Fidesz party convincingly into a majority; now it's holding 133 of 199 parliamentary seats; more than enough to make constitutional changes . Prime Minister Orban has taken a leading role in opposing German Chancellor Angela Merkel over the migration issue. At the 22 October meeting of the European’s People’s Party congress in Madrid, Prime Minister Orban blamed Greece for not taking stronger measures to contain refugees and step up border controls along the southern Hungarian-Slovenia border. He went on stating “...Europe is currently rich and weak. This is the most possibly dangerous mixture. We seem not to be able to overcome our challenges on our own...” He further stated that : “...What we have been facing is not a refugee crisis... ...This is a migratory movement composed of economic migrants, refugees and also foreign fighters... ...70% of the migrants are young men and they look like an army...”

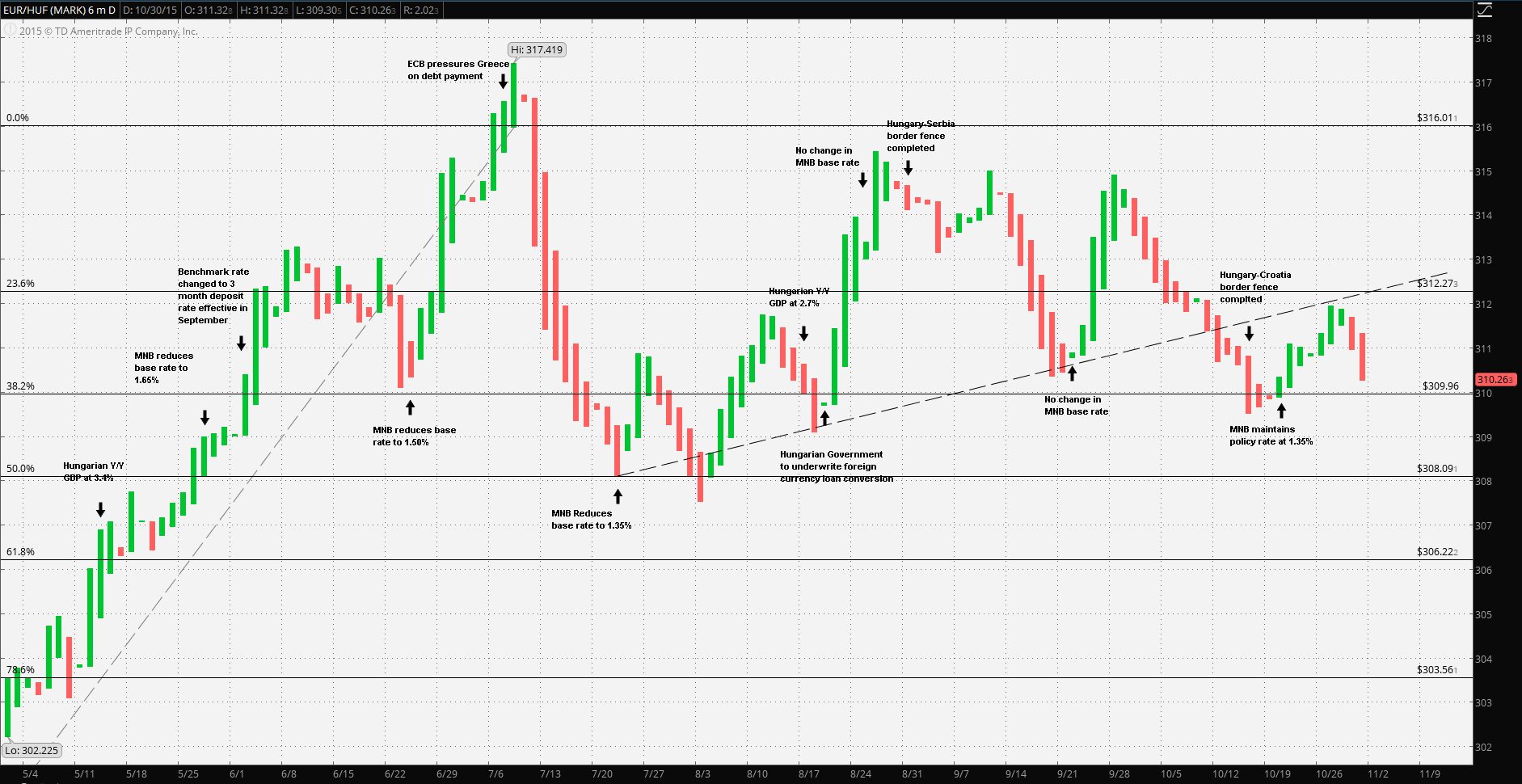

On 15 October, Hungarian spokesperson Janos Lazar announced the Hungary-Croatia border as sealed . On 30 August, 2015 Hungary completed its 13 foot high 108 mile fence along the Serbia border . Hungary is a signatory to the Schengen agreement; however it took unilateral action to close its borders. And this is the point of the matter. It isn’t that the CEE non-Euro-Zone members will suddenly secede from the EU, but the election mandates gives the leadership more domestic leverage. Hence, the possibility that political action might suddenly affect the EUR/HUF exchange.

At the 20 October Monetary Policy Council meeting of the MNB, it was decided to maintain policy rates, citing “...economic activity is strengthening, there continues to be a degree of unused capacity in the economy, and therefore the domestic real economic environment continues to have a disinflationary impact. Inflation remains substantially below the Bank’s target...” The MNB has reduced its benchmark rate five times in 2015, starting at 2.10% in January, and ending at 1.35% in July. The Forint has been strengthening vs the Euro since early July. Over the previous six months the Forint saw its weakest 7 July, at the height of the Greek debt impasse. Within two weeks it had gained 2.93%, before resuming a gradual weakening trend to 311.72 Forints to the Euro.

With the increasing likelihood of further ECB easing, non-Eurozone member central banks will have to follow suit. Else, a stronger Forint will affect Hungary’s export economy. MNB Deputy Governor Marton Nagy recently stated that “...The base rate can remain low for a sustained period, even in 2018, but I cannot rule out that even in 2019, beyond the policy horizon... ...Negative real interest rates are not just an opportunity but a must... ...Inflation targeting is the most important, but inflation targeting also allows real interest rates to turn negative, even on a sustained basis... ...while the inflation target is achievable, negative real interest rates must be maintained to close the output gap...” He went on to note that in addition there would also be a lending stimulus package. This is contrary to what most analysts had expected: a tightening of monetary policy by the end of 2017.

Hence, the MNB is already preparing to stimulate the economy, well ahead of the ECB easing. It’s widely expected that the ECB will expand its QE program in December. The next interest rate-setting meeting for the MNB is 17 November.

Although it seems that the MNB will lead the ECB by weakening the Forint first, the mix of populist politics plus a slowing economy will no doubt drive the wedge between the east-west EU divide.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.