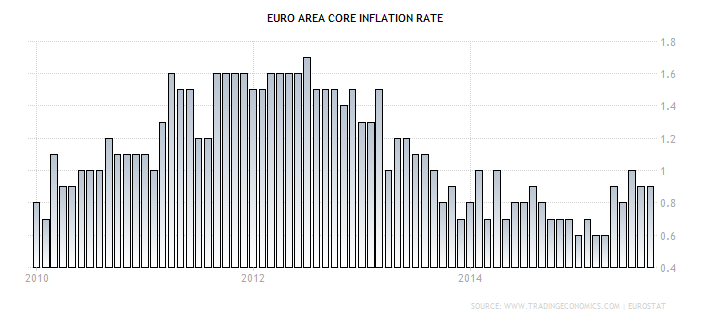

As a member of the EU the UK imports the bulk of its goods from its EU partners, which naturally includes the Eurozone. Of the UK’s 15 primary import origination, over 75% are fellow EU member states, and 92% of those are Eurozone members. The Eurozone is still struggling with disinflation if not outright deflation. The effect this trade is having on UK import prices is clear. Import prices have steadily declined from early 2014 to the present, coinciding with the steady weakening of the Euro vs the Pound Sterling.

Recently, it seems as though the ECB has been signaling, perhaps as a warning against currency manipulations or perhaps as an indication that the current QE program is not adequate enough. For example, a the 3 September ECB Governing Council press conference, ECB President Draghi emphasizedi that the program would continue until September 2016 or “...beyond if necessary... ...The information available indicates a continued, though somewhat weaker, economic recovery and a slower increase in inflation rates compared with earlier expectations... ...there are downside risks...” Mr. Draghi went on to note that it was possible that inflation rates could drop below zero in the Eurozone before reversing. Specifically he said “...We may see negative numbers of inflation in the coming months: is that deflation?... ...The Governing Council tends to think that these are transitory effects mostly due to oil-price effects. However, as I said before, we’ll closely monitor all incoming information and the Governing Council wanted to emphasize in the discussion we had today its willingness to act, its readiness to act and its capacity to act, its ability to act...”

One of the Governing Council’s decisions at the meeting was to raise the asset purchase ceiling to 33% of each issue from 25%.

These comments were followed on 15 September at the annual Kansas City Federal Reserve Symposium when ECB Vice President Vitor Constancio compared the current asset purchase program to other programs as a percentage of GDPii: “...The total amount that we have purchased represents 5.3 percent of the GDP of the euro area, whereas what the Fed has done represents almost 25 percent of the U.S. GDP, what the Bank of Japan has done represents 64 percent of the Japanese GDP and what the U.K. has done 21 percent of the UK’s GDP...”

The case could be made that the disinflationary trend is not exactly being caused by declining energy prices, but rather is contributing to other, already existing disinflationary factors.

The UK is also experiencing low CPI however, the Pound Sterling is persistently strong against the majors. From the start of the year, the UK economy had been growing strongly enough to cause the BOE to consider a rate increase by year’s end. However, February’s inflation data registered 0.0%, a record low at that time and down from January’s 0.3% rateiii. Within a week, revised 2014 Q4 GDP indicated better than expected growthiv. Another indication of an imbalance was a record high current account deficit which would indicate that the import value of goods and services had exceeded the value of those exportedv. Minutes from the March meeting noted that the, “...current account deficit was large and could, in adverse circumstances, trigger the deterioration in market sentiment towards the United Kingdom... ...The committee agreed to keep their assessment of this risk under close review and would monitor the maturity and liquidity of the financing of the deficit...”

The pieces seem to fit together. The ‘lion’s share’ of imports are from the Eurozone; a GBP which had greatly appreciated vs the Euro; reasonably strong domestic spending, a record high current account deficit and virtually zero price inflation. If so, this creates a ‘conundrum’ for the BOE: if the BOE bias is towards a rate increase, while the ECB bias is towards a weaker Euro, the stronger Pound Sterling vs a weaker Euro would only serve to depress import prices, in particular, goods and services, further increasing capital outflows.

However, UK economic data which followed was inconsistent, particularly in GDP growthvi. The situation for the BOE paralleled that of the US Fed: sometimes strong data, sometimes weak, high employment along with low wage and price growth. The last straw for a delay in benchmark rate increases by the BOE as well as the US Fed was the collapse of global commodity prices as well as the contraction in the Chinese economy. The uncertainty of the global effect has put the BOE on hold, however, the global effect may further deflate the Eurozone economy causing the ECB to expand their QE. On 15 October, ECB Governing Council member Ewald Nowotny had stated in a speechvii that, “...we need stronger economic growth... ...but it is quite obvious that in the current macroeconomic situation additional sets of instruments are necessary...”, which may possibly be interpreted as a further indication towards expanding QE.

Since the 52 week, 20 July low of £0.69529, the Euro has gained on the pound by about 6.23% to £0.7337. With the BOE most likely on hold until 2016, and a weakening global economy, it’s reasonable to expect a further weakening of Euro.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.