In the last 24 hours the AUD/USD has again tested the key support level at 0.76 and enjoyed some solid support. In the last few days the Australia dollar is starting to feel some selling pressure from the 0.77 level as its eyes remain firmly focused on the long term support level at 0.76. To close out last week the AUD/USD fell sharply lower below 0.77 however it found solid support from the long term support level at 0.76. This level has provided solid support throughout most of this year and has now been called upon again in the last week again. Throughout last week the AUD/USD eased lower and was enjoying support from the key 0.77 level before giving way. A couple of weeks ago it surged higher from below 0.77 up to a three week high, however it ran straight into resistance at the key 0.7850 level, which has performed this role several times this year. A couple of weeks ago it also spent most of its time trading quite steady around the 0.7750 level whilst receiving solid support from 0.77.

Over the last month the resistance level at 0.7850 has played a major role and continues to place selling pressure down on the AUD/USD. Throughout this same period it has been enjoying rock solid support from the long term support level at 0.76 which has allowed it to rebound strongly back up to above 0.78 on more than one occasion. Throughout the second half of May the Australian dollar fall sharply from a four month high above 0.8150 down to the key support level at 0.76. This level has been a significant level for a couple of months and has propped the Australian dollar up on multiple occasions. This recent price action has been a significant reversal as it wasn’t so long ago, the AUD/USD was in a solid medium term up trend having broken through the key 0.7850 level and achieved the four month high above 0.8150.

For most of this year the Australian dollar has traded within a wide trading range between the support at 0.76 and resistance around 0.7850. Earlier this year in February that range was tighter with the support level higher at 0.77. Throughout this period it experienced reasonable swings back and forth between the two key levels with very few excursions beyond the levels. The key level presently remains 0.76 and it will be interesting to see how well the support at this level can hold up and stop the strong down trend the AUD/USD has experienced over the last few weeks. The 4 hour chart below shows how steady the recent decline has been but equally how significant the 0.76 level in being able to temporarily halt the decline.

(Daily chart / 4 hourly chart below)

AUD/USD July 2 at 23:45 GMT 0.7638 H: 0.7640 L: 0.7630

AUD/USD Technical

During the early hours of the Asian trading session on Friday, the Australian dollar is easing back from the 0.77 level back towards the 0.76 after surging up to there in the last couple of days. Current range: trading right below 0.7650.

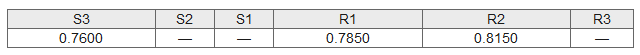

Further levels in both directions:

- Below: 0.7600.

- Above: 0.7850 and 0.8150.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.