Throughout this week the AUD/USD has eased lower and is has been recently enjoying support from the key 0.77 level. Towards the end of last week it surged higher from below 0.77 up to a three week high. It did however, run straight into resistance at the key 0.7850 level, which has performed this role several times this year. The Australian dollar is presently consolidating in a narrow range right above 0.7750 after easing away from the key resistance level at 0.7850. Throughout most of last week the Australian dollar has traded quite steady around the 0.7750 level whilst receiving solid support from 0.77 before its recent surge higher. To start last week it took advantage of the support at 0.77.

Over the last few weeks the resistance level at 0.7850 has played a major role and continues to place selling pressure down on the AUD/USD. Throughout this same period it has been enjoying rock solid support from the long term support level at 0.76 which has allowed it to rebound strongly back up to above 0.78 on more than one occasion. Throughout the second half of May the Australian dollar fall sharply from a four month high above 0.8150 down to the key support level at 0.76. This level has been a significant level for a couple of months and has propped the Australian dollar up on multiple occasions. This recent price action has been a significant reversal as it wasn’t so long ago, the AUD/USD was in a solid medium term up trend having broken through the key 0.7850 level and achieved the four month high above 0.8150.

For most of this year the Australian dollar has traded within a wide trading range between the support at 0.76 and resistance around 0.7850. Earlier this year in February that range was tighter with the support level higher at 0.77. Throughout this period it experienced reasonable swings back and forth between the two key levels with very few excursions beyond the levels. The key level presently remains 0.76 and it will be interesting to see how well the support at this level can hold up and stop the strong down trend the AUD/USD has experienced over the last few weeks. The 4 hour chart below shows how steady the recent decline has been but equally how significant the 0.76 level in being able to temporarily halt the decline.

(Daily chart / 4 hourly chart below)

AUD/USD June 24 at 02:40 GMT 0.7741 H: 0.7758 L: 0.7727

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the Australian dollar is easing back towards the key 0.77 level after finishing last week easing back from the resistance at 0.7850. Current range: trading right above 0.7700.

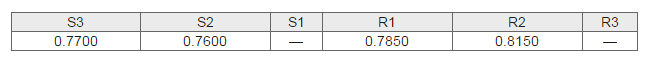

Further levels in both directions:

- Below: 0.7700 and 0.7600.

- Above: 0.7850 and 0.8150.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.