In the last 24 hours the Australian dollar has surged higher to a two week high and in doing so surged through the key resistance level at 0.77. After placing great pressure on the resistance level at 0.77 over the last week, the Australian dollar fell heavily earlier this week before surging higher again in the last couple of days. Over the best part of the last couple of weeks, the Australian dollar has relied heavily on support at the 0.76 level after falling away sharply to down below the key 0.77 level over the course of the week prior, and it is relying on this level again presently. Throughout last week it has felt significant resistance from the key 0.77 level which has been severely tested during this period and it will be interesting to see whether this level now acts as some support. Its next obvious support level is down at 0.7550 and it will hoping to be propped up by it. Its recent decline was from the key 0.7850 level after surging higher to a new two month high above 0.79 earlier a few weeks ago.

For a couple of weeks it moved back and forth from below 0.76 and up to the key resistance level at 0.7850 and higher, before the recent fall. Back in early March the Australian dollar made a statement and broke down strongly through the key 0.77 level which then provided significant resistance for the following few days. It was also able to enjoy some short term support around 0.7550 which propped it up and allowed it to rally strongly back up to above 0.79. Throughout February the Australian dollar made repeated attempts to move up strongly to the resistance level at 0.7850 however it was rejected every time and sent back easing lower, which is why this level remains significant presently. Just prior to that towards the end of February the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200.

Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

Australia’s jobless rate unexpectedly fell in March, spurring a jump in the local dollar on optimism the central bank’s effort to shore up the economy with record-low interest rates is paying off. Unemployment dropped to 6.1 percent from a revised 6.2 percent in February, as the number of people employed rose 37,700, the statistics bureau said in Sydney on Thursday. The currency extended gains as traders pared bets on the scale of rate cuts, after the report reinforced data showing improved business confidence in March. The Reserve Bank of Australia kept borrowing costs at 2.25 percent last week, after cutting in February, as it seeks to encourage spending by consumers and companies to offset falling mining investment.

(Daily chart / 4 hourly chart below)

AUD/USD April 16 at 23:50 GMT 0.7789 H: 0.7822 L: 0.7673

AUD/USD Technical

During the early hours of the Asian trading session on Thursday, the AUD/USD is easing back slightly after recently running into the resistance at 0.77 again. Current range: trading right below 0.7700.

Further levels in both directions:

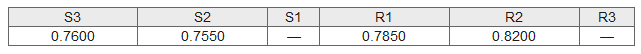

- Below: 0.7600 and 0.7550.

- Above: 0.7850 and 0.8200.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.