The Australian dollar has fallen sharply over the last month which has culminated in a new six year low near 0.7200 towards the end of last week. It has spent the last week trading right around the key 0.73 level after enjoying some support from around 0.7260. For the best part of the last few weeks the AUD/USD has traded in a narrow range between 0.74 and 0.75 with the former providing reasonable support and the latter providing stiff resistance during this time. It had been relying upon support at 0.74 and testing this level however this has now been broken and the AUD/USD has been consolidating around the 0.73 level for the last week or so. Back at the end of June the Australia dollar was starting to feel some selling pressure from the 0.77 level and it had its eyes firmly focused on the long term support level at 0.76.

In the first half of June the Australian dollar surged higher from below 0.77 up to a three week high, however it ran straight into resistance at the key 0.7850 level, which has performed this role several times this year. Throughout this time it also spent most of its time trading quite steady around the 0.7750 level whilst receiving solid support from 0.77. Over the last couple of months the resistance level at 0.7850 has played a major role and continues to place selling pressure down on the AUD/USD. Throughout this same period it has been enjoying rock solid support from the long term support level at 0.76 which has allowed it to rebound strongly back up to above 0.78 on more than one occasion.

Throughout the second half of May the Australian dollar fall sharply from a four month high above 0.8150 down to the key support level at 0.76. This level has been a significant level for a couple of months and has propped the Australian dollar up on multiple occasions. This recent price action has been a significant reversal as it wasn’t so long ago, the AUD/USD was in a solid medium term up trend having broken through the key 0.7850 level and achieved the four month high above 0.8150. For most of this year the Australian dollar has traded within a wide trading range between the support at 0.76 and resistance around 0.7850. Earlier this year in February that range was tighter with the support level higher at 0.77. Throughout this period it experienced reasonable swings back and forth between the two key levels with very few excursions beyond the levels.

(Daily chart / 4 hourly chart below)

AUD/USD August 4 at 00:20 GMT 0.7272 H: 0.7321 L: 0.7260

AUD/USD Technical

During the early hours of the Asian trading session on Tuesday, the Australian dollar is trying to keep in touch with the 0.73 and 0.74 levels after spending most of last couple of weeks consolidating and trading around these levels. Current range: trading right around 0.7270.

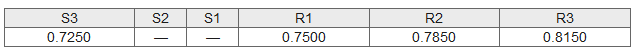

Further levels in both directions:

- Below: 0.7250

- Above: 0.7500, 0.7850 and 0.8150.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.