The Australian dollar hasn’t had its best week falling sharply from above the key 0.77 level to a new six year low below 0.75. The AUD/USD is presently trading around the 0.75 where it has found some much needed support. A few times last week the AUD/USD tested the key support level at 0.76 and enjoyed some solid support before it failed. Throughout last week the Australia dollar was starting to feel some selling pressure from the 0.77 level and it had its eyes firmly focused on the long term support level at 0.76. A couple of weeks ago the AUD/USD fell sharply lower below 0.77 however it found solid support from the long term support level at 0.76. This level has provided solid support throughout most of this year so it is quite significant that it has now been strongly broken.

A few weeks ago it surged higher from below 0.77 up to a three week high, however it ran straight into resistance at the key 0.7850 level, which has performed this role several times this year. Throughout this time it also spent most of its time trading quite steady around the 0.7750 level whilst receiving solid support from 0.77. Over the last month the resistance level at 0.7850 has played a major role and continues to place selling pressure down on the AUD/USD. Throughout this same period it has been enjoying rock solid support from the long term support level at 0.76 which has allowed it to rebound strongly back up to above 0.78 on more than one occasion.

Throughout the second half of May the Australian dollar fall sharply from a four month high above 0.8150 down to the key support level at 0.76. This level has been a significant level for a couple of months and has propped the Australian dollar up on multiple occasions. This recent price action has been a significant reversal as it wasn’t so long ago, the AUD/USD was in a solid medium term up trend having broken through the key 0.7850 level and achieved the four month high above 0.8150. For most of this year the Australian dollar has traded within a wide trading range between the support at 0.76 and resistance around 0.7850. Earlier this year in February that range was tighter with the support level higher at 0.77. Throughout this period it experienced reasonable swings back and forth between the two key levels with very few excursions beyond the levels.

(Daily chart / 4 hourly chart below)

AUD/USD July 6 at 23:40 GMT 0.7493 H: 0.7501 L: 0.7492

AUD/USD Technical

During the early hours of the Asian trading session on Tuesday, the Australian dollar is trying to stay above the 0.75 level after falling sharply to a six year low below 0.75. Current range: trading right around 0.75.

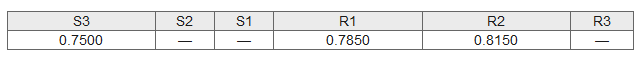

Further levels in both directions:

- Below: 0.7500.

- Above: 0.7850 and 0.8150.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to hold above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.