To close out last week the AUD/USD fell sharply lower below 0.77 however it found solid support from the long term support level at 0.76. This level has provided solid support throughout most of this year and has now been called upon again. Throughout last week the AUD/USD eased lower and was enjoying support from the key 0.77 level before giving way. A couple of weeks ago it surged higher from below 0.77 up to a three week high, however it ran straight into resistance at the key 0.7850 level, which has performed this role several times this year. A couple of weeks ago it also spent most of its time trading quite steady around the 0.7750 level whilst receiving solid support from 0.77.

Over the last month the resistance level at 0.7850 has played a major role and continues to place selling pressure down on the AUD/USD. Throughout this same period it has been enjoying rock solid support from the long term support level at 0.76 which has allowed it to rebound strongly back up to above 0.78 on more than one occasion. Throughout the second half of May the Australian dollar fall sharply from a four month high above 0.8150 down to the key support level at 0.76. This level has been a significant level for a couple of months and has propped the Australian dollar up on multiple occasions. This recent price action has been a significant reversal as it wasn’t so long ago, the AUD/USD was in a solid medium term up trend having broken through the key 0.7850 level and achieved the four month high above 0.8150.

For most of this year the Australian dollar has traded within a wide trading range between the support at 0.76 and resistance around 0.7850. Earlier this year in February that range was tighter with the support level higher at 0.77. Throughout this period it experienced reasonable swings back and forth between the two key levels with very few excursions beyond the levels. The key level presently remains 0.76 and it will be interesting to see how well the support at this level can hold up and stop the strong down trend the AUD/USD has experienced over the last few weeks. The 4 hour chart below shows how steady the recent decline has been but equally how significant the 0.76 level in being able to temporarily halt the decline.

(Daily chart / 4 hourly chart below)

AUD/USD June 28 at 23:50 GMT 0.7616 H: 0.7655 L: 0.7587

AUD/USD Technical

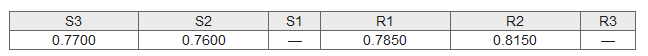

During the early hours of the Asian trading session on Monday, the Australian dollar is resting on support at the key 0.76 level after finishing last week falling strongly down to this level. Current range: trading right above 0.7600.

Further levels in both directions:

- Below: 0.7600.

- Above: 0.7850 and 0.8150.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.