In the last week the Australian dollar has fallen sharply from above 0.8150 down to a two week low near 0.7850, where it has enjoyed solid support from this key level. Last week the Australian dollar enjoyed a solid week which culminated in a new three month high above 0.8150 in the middle of last week before easing lower. The last few weeks has seen the Australian dollar on a roller-coaster ride moving from below 0.78 and up to near 0.82. A couple of weeks ago the Australian dollar surged higher however it ran into resistance right around 0.7950 and 0.80 before easing slightly and consolidating in a narrow range between 0.7850 and 0.79 to finish out the week. A few weeks ago it enjoyed a solid start to the week, moving to a three month high just shy of 0.81. It then eased back towards the key 0.7850 level again where it received some support.

Back in early March the Australian dollar made a statement and broke down strongly through the key 0.77 level which then provided significant resistance for the following few days. It was also able to enjoy some short term support around 0.7550 which propped it up and allowed it to rally strongly back up to above 0.79. Throughout February the Australian dollar made repeated attempts to move up strongly to the resistance level at 0.7850 however it was rejected every time and sent back easing lower, which is why this level remains significant presently. Just prior to that towards the end of February the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200.

Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

Australia retains scope to lower interest rates further, the central bank’s second in command said, while warning against spurring a debt-fueled spending boom. “There is a fairly fine line to tread” in balancing the need to encourage household spending and business investment while preventing imbalances emerging in the economy, Deputy Governor Philip Lowe said in Sydney Monday. Australia has been trying to engineer a transition from mining since late 2011 when investment and commodity prices peaked. Responding to an audience question on the policy outlook after his speech, Lowe said “nothing has changed” despite the central bank not having provided future guidance when it cut rates to a record-low 2 percent on May 5. “We still have scope to lower interest rates if we need to. That doesn’t mean we’re going to, but we have scope to do that,” Lowe said.

(Daily chart / 4 hourly chart below)

AUD/USD May 21 at 23:50 GMT 0.7895 H: 0.7913 L: 0.7865

AUD/USD Technical

During the early hours of the Asian trading session on Friday, the AUD/USD is trading in a very narrow range between 0.7890 and 0.79. Current range: trading right below 0.79.

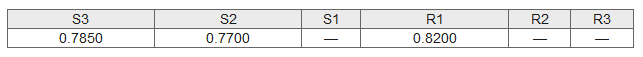

Further levels in both directions:

- Below: 0.7850 and 0.7700.

- Above: 0.8200.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.