The Australian dollar enjoyed a solid week last week moving off support around 0.76 to reach a three week high just shy of the resistance level at 0.7850. In doing so, it moved through the key resistance level at 0.77. After placing great pressure on the resistance level at 0.77 a couple of weeks ago, the Australian dollar fell heavily earlier last week before surging higher again to finish out the week. Over the best part of the last few weeks, the Australian dollar has relied heavily on support at the 0.76 level after falling away sharply to down below the key 0.77 level over the course of the week prior, and it is relying on this level again presently. Throughout the last couple of weeks it felt significant resistance from the key 0.77 level which has been severely tested during this period and it will be interesting to see whether this level now acts as some support.

Its next obvious support level is down at 0.7550 and it will hoping to be propped up by it. For a couple of weeks it moved back and forth from below 0.76 and up to the key resistance level at 0.7850 and higher, before the recent fall. Back in early March the Australian dollar made a statement and broke down strongly through the key 0.77 level which then provided significant resistance for the following few days. It was also able to enjoy some short term support around 0.7550 which propped it up and allowed it to rally strongly back up to above 0.79. Throughout February the Australian dollar made repeated attempts to move up strongly to the resistance level at 0.7850 however it was rejected every time and sent back easing lower, which is why this level remains significant presently. Just prior to that towards the end of February the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200.

Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

Australia’s jobless rate unexpectedly fell in March, spurring a jump in the local dollar on optimism the central bank’s effort to shore up the economy with record-low interest rates is paying off. Unemployment dropped to 6.1 percent from a revised 6.2 percent in February, as the number of people employed rose 37,700, the statistics bureau said in Sydney on Thursday. The currency extended gains as traders pared bets on the scale of rate cuts, after the report reinforced data showing improved business confidence in March. The Reserve Bank of Australia kept borrowing costs at 2.25 percent last week, after cutting in February, as it seeks to encourage spending by consumers and companies to offset falling mining investment.

(Daily chart / 4 hourly chart below)

AUD/USD April 20 at 02:15 GMT 0.7811 H: 0.7831 L: 0.7780

AUD/USD Technical

During the early hours of the Asian trading session on Monday, the AUD/USD is rallying a little higher above 0.78 with eyes on the resistance level at 0.7850. Current range: trading right above 0.7850.

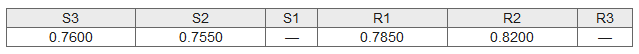

Further levels in both directions:

- Below: 0.7600 and 0.7550.

- Above: 0.7850 and 0.8200.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.