After placing great pressure on the resistance level at 0.77 over the last week, the Australian dollar fell heavily in the last 24 hours to back below 0.76 where it is presently trying to hold onto. Over the best part of the last couple of weeks, the Australian dollar has relied heavily on support at the 0.76 level after falling away sharply to down below the key 0.77 level over the course of the week prior. Throughout last week it has felt significant resistance from the key 0.77 level which has been severely tested during this period. The AUD/USD has surged strongly higher and made repeated attempts to push through, however the resistance at 0.77 has stood tall and fended off the buyers at this stage. Its next obvious support level is down at 0.7550 and it will hoping to be propped up by it. Its recent decline was from the key 0.7850 level after surging higher to a new two month high above 0.79 earlier a few weeks ago.

For a couple of weeks it moved back and forth from below 0.76 and up to the key resistance level at 0.7850 and higher, before the recent fall. Back in early March the Australian dollar made a statement and broke down strongly through the key 0.77 level which then provided significant resistance for the following few days. It was also able to enjoy some short term support around 0.7550 which propped it up and allowed it to rally strongly back up to above 0.79. Throughout February the Australian dollar made repeated attempts to move up strongly to the resistance level at 0.7850 however it was rejected every time and sent back easing lower, which is why this level remains significant presently. Just prior to that towards the end of February the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200.

Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

The big moment for economists last week was the Reserve Bank’s decision to keep the cash rate on hold for a second straight month. Westpac’s chief economist Bill Evans was one of a sizeable number who had thought an April cut more likely than not. Even so, he had acknowledged a good chance of a May move in keeping with the historical pattern of the RBA favouring moves soon after the release of quarterly inflation figures. Westpac now expects a May cut, with Mr Evans highlighting the RBA’s use of the term “for the time being” to describe the appropriateness of the current cash rate of 2.25 per cent. “Following the recent introduction of that term in the March statement, we observed that on the eight occasions that it was used since the beginning of 2009, there has always been a follow-up move within two months,” he said. ANZ’s chief economist Warren Hogan suggested there may not have been a move in April “simply because the case is not there yet”. It could even be that there will be no more cuts this year, he said. “However, we doubt that this recent monetary policy adjustment will be a one and done, and we have pencilled in a cut in May.”

(Daily chart / 4 hourly chart below)

AUD/USD April 14 at 00:05 GMT 0.7588 H: 0.7680 L: 0.7553

AUD/USD Technical

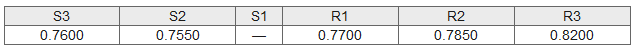

During the early hours of the Asian trading session on Tuesday, the AUD/USD is trying to rally back to the support level at 0.76. Current range: trading right around 0.7590.

Further levels in both directions:

- Below: 0.7600 and 0.7550.

- Above: 0.7700, 0.7850 and 0.8200.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.