After finally springing to life in the middle of last week, the Australian dollar dropped sharply to close out the week and fall back down below 0.7800 again to more familiar territory below the resistance level at 0.7850. In the last 24 hours however it has reversed and moved back up strongly to the resistance level at 0.7850 before easing lower in recent hours. During last week the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. For the last month the Australian dollar has steadied well and traded in a narrow range between support at 0.77 and 0.78, although a couple of weeks ago it rallied higher to a two week high near 0.7850. To start last week it slowly eased back a little from resistance at 0.7850 however it is finally made its way through there. It has enjoyed receiving solid support from the 0.77 level throughout this time and will be looking to receive further support in the coming days. A few weeks ago it rallied a little higher again back towards 0.78 however it then eased back to receive more support from 0.77. Several weeks ago the Australian dollar was on a roller-coaster ride dropping sharply to a new multi-year low below 0.7630 before rallying strongly and moving back up above the 0.77 level and more recently 0.78.

In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200. Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. It seems a long way away now but the Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

The RBA on Tuesday held back on further monetary easing, surprising most market watchers who expected a second rate cut in as many months. The central bank kept the benchmark lending rate at a historic record low of 2.25 percent, despite expectations it would do more to battle weak employment, easing inflation and sluggish corporate profits. The RBA lowered rates by 25 basis points last month, its first cut in 18 months, following moves by some 20 central banks around the world that have loosened monetary policy this year. The decision comes on the heels of a surprise announcement by the People’s Bank of China over the weekend to lower its rates, its third aggressive move to stimulate the economy in the last five months. The Australian dollar surged nearly half a cent, from $0.7797 to $7834. Meanwhile, the benchmark S&P ASX 200 index fell into the red, down 0.3 percent. In a statement, the RBA said it’s “appropriate” to leave rates steady for the time being but left the door open for further easing in the future where necessary. It maintained that growth will continue at a below-trend pace and sees domestic demand remaining weak.

(Daily chart / 4 hourly chart below)

AUD/USD March 3 at 21:55 GMT 0.7819 H: 0.7844 L: 0.7752

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the AUD/USD is easing a little lower back towards 0.7800 after rallying up strongly in the last 24 hours back to the resistance level at 0.7850. Current range: trading right above 0.7800 around 0.7820.

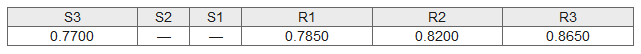

Further levels in both directions:

- Below: 0.7700.

- Above: 0.7850, 0.8200, and 0.8650.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.