The Australian dollar has seen its sharpest fall in over 12 months as it fell strongly every day last week from near 0.94 down to a six month low at 0.90 to start this week. The doldrums that have befallen the Euro and pound over the last couple of months have finally been caught by the Australian dollar. The long term key level at 0.90 will no doubt be monitored and be called upon to desperately provide some much needed support to the Australian dollar. It showed some positive signs to finish out a couple of weeks ago as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 before falling sharply again. A few weeks ago it enjoyed a solid week moving up from below 0.9300 to a then three week high around 0.9370 before easing a little lower to finish the week. The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level.

The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

The Australian economy added 121,000 jobs in August, data from the Australia Bureau of Statistics (ABS) showed on Thursday, much higher than expectations of 12,000 jobs in a Reuters poll. The addition of 14,300 full-time jobs and 106,700 part-time jobs - the most in at least three decades - pushed the unemployment rate down to 6.1 percent, after hitting a 12-year high of 6.4 percent in July. Expectations were for a 6.3 percent reading. Following the data the Australian dollar gained over half a cent against the U.S. dollar, rising as high as $0.9216 after touching a five-month low of $0.9113 in the previous session. Against the New Zealand dollar it rose to 1.1222 from 1.1150. Australia's S&P/ASX 200 index was down 0.1 percent.

(Daily chart / 4 hourly chart below)

AUD/USD September 15 at 01:55 GMT 0.9009 H: 0.9036 L: 0.8999

AUD/USD Technical

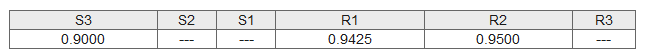

During the early hours of the Asian trading session on Monday, the AUD/USD is drifting lower towards the key 0.90 level as it presently sits there waiting to see if the support will hold. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to near 0.95 again. Current range: trading right around 0.9000.

Further levels in both directions:

- Below: 0.9000.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.