The last few weeks has seen a strong decline for the Australian dollar moving from close to 0.94 down to below 0.87 and an eight month low in the process. In the last few days it has taken a breather above 0.87 around 0.8750. A couple of weeks ago the Australian dollar found some much needed support at 0.8950 and rallied back up to just shy of the key 0.90 level before resuming its decline. The long term key level at 0.90 was called upon to desperately provide some much needed support to the Australian dollar, which it did a little a couple of weeks ago, however it has more recently provided resistance. Several weeks ago the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory.

The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

Australian home price rises are easing from their double-digit gains, after most capital cities recorded price falls in September. Home values were virtually flat last month, rising by just 0.1 per cent, but were up 9.3 per cent for the year to September. In the 2013/14 financial year prices rose 10.1 per cent. The weaker result in September was caused by falls in prices in five of the eight capital cities, the RP Data Rismark Home Value Index showed on Wednesday. Darwin had the biggest fall, followed by Melbourne, Canberra and Perth. Adelaide recorded the strongest growth at 0.9 per cent. But home prices in the nation’s largest city remained strong, with Sydney posting a gain of 0.8 per cent in the month and 14 per cent for the year. Sydney was again the most expensive city to buy a home, with a median price of $655,000, more than double the $300,000 recorded in Hobart. RP Data research director Tim Lawless said the easing of home prices in September should be welcomed by the Reserve Bank, which has flagged concerns about rises in Sydney and Melbourne as well as speculative property investors.

(Daily chart / 4 hourly chart below)

AUD/USD October 1 at 23:40 GMT 0.8730 H: 0.8750 L: 0.8663

AUD/USD Technical

During the early hours of the Asian trading session on Thursday, the AUD/USD is consolidating right around 0.8750 after recently rallying higher from around 0.8700. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to near 0.95 again earlier this year. Current range: trading right around 0.8750.

Further levels in both directions:

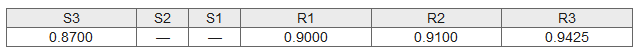

- Below: 0.8700.

- Above: 0.9000, 0.9100 and 0.9425.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to hold above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.