The last few weeks has seen a strong decline for the Australian dollar moving from close to 0.94 down to below 0.87 and an eight month low in the process. In the last couple of days it has taken a breather above 0.87 around 0.8750. A couple of weeks ago the Australian dollar found some much needed support at 0.8950 and rallied back up to just shy of the key 0.90 level before resuming its decline. The long term key level at 0.90 was called upon to desperately provide some much needed support to the Australian dollar, which it did a little a couple of weeks ago, however it has more recently provided resistance. Several weeks ago the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory.

The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

Australian consumer confidence is stabilizing as households become more optimistic about their finances. The ANZ/Roy Morgan weekly consumer confidence index rose 0.7 per cent in the week ending September 28. The index has stabilised around its long-run average in the past two months after a sharp decline around the time of the federal budget in May. ANZ chief economist Warren Hogan is confident that consumer spending will improve in the coming months now that people are feeling more confident. “The trajectory of consumer confidence remains key for the recovery in consumer spending, which in turn will be supported by gains in household wealth on the one hand but constrained by subdued household income growth on the other hand,” he said. While consumers are more satisfied about their own situation, there is still nervousness about the economy. The index that measures expectations about economic conditions for the coming year and the next five years fell one per cent and 6.3 per cent respectively last week.

(Daily chart / 4 hourly chart below)

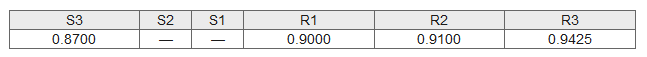

AUD/USD September 30 at 23:40 GMT 0.8746 H: 0.8767 L: 0.8693

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the AUD/USD is consolidating right around 0.8750 after recently rallying higher from around 0.8700. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to near 0.95 again earlier this year. Current range: trading right around 0.8750.

Further levels in both directions:

- Below: 0.8700.

- Above: 0.9000, 0.9100 and 0.9425.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.