The last few weeks has seen a strong decline for the Australian dollar moving from close to 0.94 down to below 0.88 and a seven month low in the process. A couple of weeks ago the Australian dollar found some much needed support at 0.8950 and rallied back up to just shy of the key 0.90 level before resuming its decline. The long term key level at 0.90 was called upon to desperately provide some much needed support to the Australian dollar, which it did a little a couple of weeks ago, however it has more recently provided resistance. Several weeks ago the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory.

The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

Inflated Australian house prices could take a downwards turn if the belts are tightened on banks’ lending criteria and result in a halt to surging property prices across the country. The Reserve Bank of Australia has sent out a stern warning to Australian property owners that it needs to take measures to control the booming housing market. Sydney and Melbourne property prices have soared in the past 12 months, experiencing the highest price growth of all the states at 16.2 per cent and 11.7 per cent respectively. In the RBA’s biannual Financial Stability Review released this week, it outlined the “housing and mortgage markets are becoming unbalanced” and experts say it’s time for Australians to listen up as they reassess macroprudential policies which limit higher risk lending. RP Data’s senior research analyst Cameron Kusher said the excitement among investors had been difficult to control and they continued to optimise their ability to negatively gear their property investment and pounce on the record low-rate environment.

(Daily chart / 4 hourly chart below)

AUD/USD September 28 at 23:40 GMT 0.8753 H: 0.8765 L: 0.8748

AUD/USD Technical

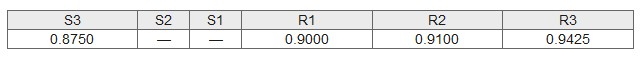

During the early hours of the Asian trading session on Monday, the AUD/USD is trying to edge higher back up to the 0.88 level, after falling down even further to finish out last week. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to near 0.95 again earlier this year. Current range: trading right around 0.8750.

Further levels in both directions:

- Below: 0.8750.

- Above: 0.9000, 0.9100 and 0.9425.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.