The Australian dollar has experienced a reasonably sharp fall in the last 24 hours breaking back down through the support level at 0.93 to a one week low around 0.9270. It enjoyed a solid week last week moving up from below 0.9300 to a three week high around 0.9370 before easing a little lower to finish the week. It started this new week in similar fashion easing lower before falling sharply in the last day. For the best part of the last few weeks the Australian dollar has traded close and around the 0.93 level after spending the preceding few weeks drifting lower from near 0.95. A couple of weeks ago it fell lower to below the 0.93 level level and down towards a two month low near 0.9220, before rallying well to return to the 0.93 level. Throughout July it generally slid lower from close to 0.95 down to its present trading levels around 0.93. It has done well of late to cling onto the 0.93 level after its sharp fall which saw it move from above 0.9400 down to a seven week low below 0.9240. Several weeks ago it was easing back below both the 0.9425 and 0.9400 levels with the former providing some resistance.

The Australian dollar reached a three week high just shy of 0.9480 a month ago after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

As expected, the RBA on Tuesday left its key cash rate at a record low of 2.5 percent, where it's been since August of last year, and suggested rates will stay on hold for a while. In a statement, the RBA said recent data show moderate growth is occurring; while resource spending is set to fall significantly, investment outside of mining is improving. Overall, the central bank expects economic growth to be below trend in the year ahead. The Australia dollar dipped 0.3 percent against the dollar on the news, while stock markets showed little reaction. "I agree that view on where the economy is going. The consumer confidence numbers that we are seeing recently certainly bounced back from concerns, and there is some confidence that service-related investments are coming into play," said Tony Farnham, economist & analyst at Patersons Securities. Further, the Australian dollar “remains above most estimates of its fundamental value, particularly given the declines in key commodity prices,” Stevens said. “It is offering less assistance than would normally be expected in achieving balanced growth in the economy.”

(Daily chart / 4 hourly chart below)

AUD/USD September 2 at 23:45 GMT 0.9280 H: 0.9337 L: 0.9268

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the AUD/USD is trying to rally higher after recently falling so sharply from above 0.93. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.95 again. Current range: trading right around 0.9280.

Further levels in both directions:

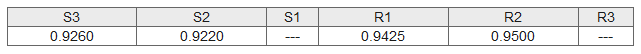

- Below: 0.9260, and 0.9220.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'