The Australian dollar is presently trying to cling onto the 0.93 level after its sharp over the last few days which saw it move from above 0.9400 down to a seven week low just below 0.9300. It has spent the last few days easing back below both the 0.9425 and 0.9400 levels with the former providing some resistance. The Australian dollar reached a three week high just shy of 0.9480 towards the end of last week after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. It started last week by slowly easing away from the resistance level around 0.9425 which continues to stand tall and play havoc with buyers. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 a few weeks ago, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time.

The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

Slow credit growth, falling export prices and a drop in home-building approvals - it was hardly an encouraging set of economic data for Australia on Thursday. But it was a pretty good illustration of the problems facing the economy. A 7.9 per cent fall in the export price index in the June quarter, reported by the Australian Bureau of Statistics on Thursday, was dominated by weaker minerals markets. It extended the fall to since the peak in 2011 to 15 per cent. The fall has been partially cushioned by a lower exchange rate. In foreign currency terms, export commodity prices have dropped over 30 per cent in just three years, according to the commodity price index compiled by the RBA. But the hit to export revenue will still drag on the economy, accentuating the impact of the slowdown in resource sector investment. The building industry is one of the great hopes for the economy's transition away from mining, the so-called rebalancing.

(Daily chart / 4 hourly chart below)

AUD/USD August 1 at 02:50 GMT 0.9287 H: 0.9318 L: 0.9285

AUD/USD Technical

During the early hours of the Asian trading session on Friday, the AUD/USD is dropping sharply back through the 0.93 level after recently rally back up higher through it. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.95 again. Current range: trading below 0.9300 around 0.9290.

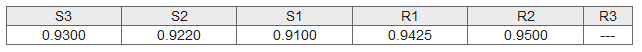

Further levels in both directions:

- Below: 0.9300, 0.9220 and 0.9100.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.